Searches for “EV manufacturers USA” are surging for a reason. In 2025, the U.S. electric-vehicle market is maturing fast: Tesla still controls close to half of EV sales, legacy automakers are finally scaling up volume, and new names like Rivian and Lucid are shaping entire segments. If you’re trying to figure out which brands matter, especially if you’re eyeing a used EV, this is where the story starts.

Quick context

Why “EV manufacturers USA” matters in 2025

Knowing the landscape of EV manufacturers in the USA isn’t just trivia. It shapes charging options, service access, incentives, resale value and even how much range you’ll get in cold weather. Unlike the gasoline world, where fuel is standardized and any mechanic can handle basic service, EV ownership is heavily influenced by which brand’s name is on the nose of your car or truck.

- Charging access: Tesla owners still enjoy the smoothest Supercharger experience, but more legacy brands are gaining access through NACS (North American Charging Standard).

- Service and parts: Ford, GM and Hyundai–Kia lean on large dealer networks; startups like Rivian and Lucid rely on factory-direct service models.

- Technology and range: Battery chemistry, software and thermal management vary widely, and they directly affect real‑world range and degradation.

- Resale and used value: Brands with strong demand and good reliability data typically hold value better, which matters if you’re shopping used.

The U.S. EV market in 2025: who’s selling what

EV manufacturers USA: 2025 snapshot

On the sales leaderboard, one story stands out: Tesla still dominates, but it no longer owns the conversation. In Q2 2025, Tesla captured close to half of U.S. EV sales, but GM, Ford and Hyundai–Kia have carved out meaningful shares, and upstarts like Rivian and Lucid now show up in the national data, not just press releases.

Major EV manufacturers in the USA

The heavyweights: top EV manufacturers in the USA

From volume leaders to luxury specialists, these brands shape most of the U.S. EV market.

Tesla

What they sell: Model 3/Y sedans and crossovers, plus Model S/X and Cybertruck.

- Still the volume leader in U.S. EV sales.

- Owns the country’s largest DC fast‑charging network.

- Software‑heavy approach, frequent over‑the‑air updates.

General Motors (Chevy, GMC, Cadillac)

What they sell: Chevy Equinox EV, Blazer EV, Silverado EV; Cadillac Lyriq and others.

- Rapidly growing EV output off its Ultium platform.

- Targets mass‑market crossovers plus premium luxury.

- Dealer network reach is a big selling point in the U.S.

Ford Motor Company

What they sell: Mustang Mach‑E, F‑150 Lightning, E‑Transit and more coming.

- Strong play in pickups and commercial vans.

- Dealer network and fleet presence support adoption.

- Balancing EV push with profitable hybrid and gas models.

Hyundai & Kia

What they sell: Hyundai Ioniq 5/6, Kona Electric; Kia EV6, EV9 and more.

- Known for efficient, well‑packaged EVs with strong value.

- 800‑volt architectures enable very fast DC charging.

- Competitive warranties that appeal to first‑time EV buyers.

BMW, Mercedes & other luxury imports

What they sell: BMW i4, i5, iX; Mercedes EQE/EQS; Audi e‑tron/Q4, Porsche Taycan.

- Focus on premium segments with high feature content.

- Growing U.S. EV share, especially in coastal markets.

- Complex option structures can confuse used buyers.

Stellantis, Volkswagen & others

What they sell: Jeep and Ram EVs (Stellantis), VW ID.4, plus various niche models.

- Later to the U.S. EV party but ramping product plans.

- Heavier emphasis on Europe; U.S. strategy is evolving.

- Great deals sometimes available on new and used units.

Used‑buyer tip

Rising U.S. EV startups and niche players

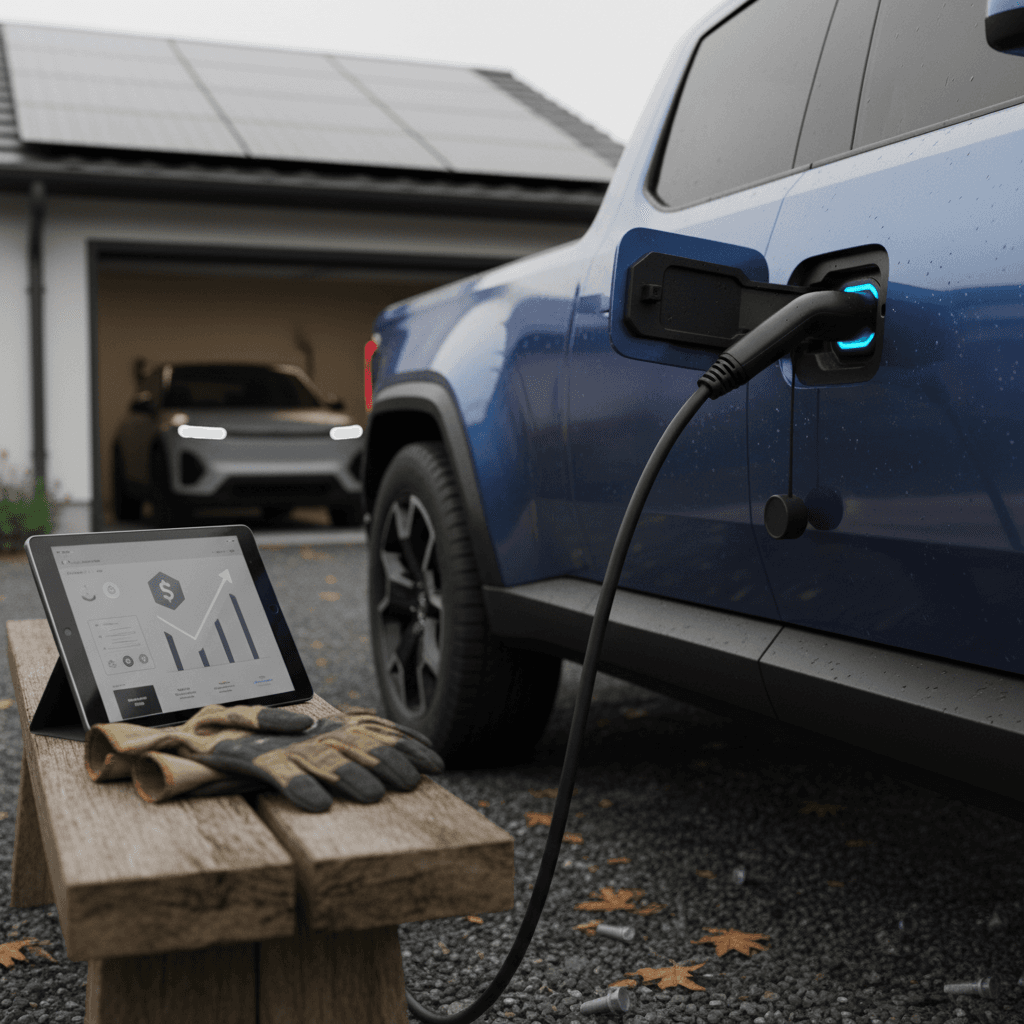

Beyond the legacy automakers, a cluster of homegrown EV startups has changed what an American‑built electric vehicle can look like. They don’t match Tesla for volume, but they over‑index on innovation, brand passion and, in some cases, price volatility in the used market.

Key U.S. EV startups to know

Small in volume, big in influence.

Rivian

HQ: Normal, Illinois (manufacturing); Irvine, California (HQ)

- Lineup includes the R1T pickup and R1S SUV, plus commercial vans.

- Strong focus on adventure, outdoors and over‑the‑air software.

- Early trucks are now hitting the used market in meaningful numbers.

Lucid Motors

HQ: Newark, California; factory in Casa Grande, Arizona

- Builds the Lucid Air and expanding into the Gravity SUV.

- Known for segment‑leading efficiency and long range.

- Ultra‑luxury pricing new, but significant depreciation used.

Commercial & specialty builders

Several U.S. players focus on buses, delivery vans and work trucks, Proterra’s legacy assets, Blue Bird, Lion Electric and others.

They matter less for retail shoppers, but they’re a big part of how cities and fleets decarbonize.

Emerging niche brands

Names like Fisker have struggled with financial stability, while others operate at very low volume.

For most retail buyers, sticking with brands that have established U.S. production footprints, or clear service plans, is the safer bet.

Startup risk check

EV manufacturers in the USA by vehicle type

Electric cars & crossovers

- Tesla: Model 3/Y dominate the EV sales charts and the used market.

- Hyundai & Kia: Ioniq 5/6 and EV6 offer strong range and fast charging.

- GM & Ford: Chevy Equinox EV, Blazer EV and Mustang Mach‑E compete in mainstream segments.

- Imports: BMW i4, Mercedes EQE, VW ID.4, Nissan Ariya and others fill out niches.

Electric trucks, SUVs & vans

- Ford: F‑150 Lightning is the most visible electric pickup in the U.S.

- GM: Silverado EV and GMC Hummer EV handle the high‑power, high‑price end.

- Rivian: R1T and R1S define the adventure‑EV category.

- Tesla: Cybertruck adds a polarizing but influential entrant.

- Commercial: Ford E‑Transit and various GM and startup vans electrify fleets.

Don’t forget body style

How EV technology differs by manufacturer

EV manufacturers share a lot of suppliers, but they make very different calls on battery chemistry, voltage, software and charging hardware. Those decisions drive day‑to‑day ownership more than most window stickers let on.

Key technology differences among U.S. EV manufacturers

How brand‑level tech decisions change the ownership experience.

| Brand / Group | Battery & range approach | Charging strengths | Notable trade‑offs |

|---|---|---|---|

| Tesla | High energy‑density packs, aggressive range estimates, strong software‑managed efficiency. | Industry‑leading Supercharger network; broad adoption of NACS by other brands helps long term. | Sparse physical service footprint in some regions; interior design and build quality feel minimalist to some buyers. |

| GM (Chevy, GMC, Cadillac) | Ultium platform supports multiple sizes; focus on mass‑market crossovers and trucks. | Fast‑charging capability is strong on newer models; building out network partnerships. | Early software hiccups and recalls on some launches; dealer familiarity with EVs still uneven. |

| Ford | Balances range with towing and work‑use capability, especially on F‑150 Lightning. | Access to both CCS and, increasingly, NACS fast charging; strong home charging packages with dealers. | Towing and cold weather can reduce real‑world range significantly; software quality has been mixed. |

| Hyundai & Kia | Efficient platforms with 800‑volt architectures on flagship models for rapid charging. | Some of the quickest public‑charging times in the industry when networks cooperate. | Battery preconditioning and routing to chargers can be less polished than Tesla’s in some markets. |

| Rivian & Lucid | Premium‑leaning, high‑capacity packs; emphasize performance and adventure or luxury. | Fast‑charging hardware is competitive; building smaller proprietary networks plus access to public sites. | Lower volumes mean fewer service locations; long‑term residual values are still being written in real time. |

Technology traits to keep in mind when you compare used EVs from different manufacturers.

Charge‑network reality check

Policy, tariffs and supply chain: what’s shaking the industry

EV manufacturers in the USA don’t operate in a vacuum. Shifting federal incentives, state policies, tariffs on imported batteries and components, and local permitting delays for charging infrastructure all shape how quickly, and where, automakers push electric models.

- Tax credits and content rules: Federal purchase incentives increasingly favor EVs assembled in North America with locally sourced battery materials, helping Tesla, GM, Ford and some Hyundai–Kia models built in U.S. plants.

- Tariffs on Chinese components: Higher tariffs raise costs for cells, cathode materials and electronics, squeezing margins and complicating sourcing for many manufacturers.

- Charging build‑out lag: Public fast‑charging is expanding, but more slowly than EV registrations, putting pressure on automakers to offer better home‑charging bundles and realistic range messaging.

- Political swings: Changes in Washington can flip the tone on EVs quickly, affecting consumer confidence and long‑term planning at automakers.

Why this matters to you

What all of this means if you’re buying a used EV

From a used‑vehicle lens, the big question isn’t just who builds EVs in the USA, but which brands age well. Battery health, software support and service access are the new three‑legged stool for used‑EV shoppers.

Checklist: evaluating used EVs from different manufacturers

1. Battery health over badge prestige

A well‑maintained Chevy Bolt EUV with a healthy pack can be a smarter buy than a heavily fast‑charged luxury EV with more degradation. Always look for objective battery‑health data, not just range estimates.

2. Charging standard & connector

Confirm whether the vehicle uses CCS, NACS or older standards, and whether adapters are included. Access to Tesla’s Supercharger network is expanding but not universal yet for every non‑Tesla brand.

3. Software and update support

Ask how often the manufacturer still delivers over‑the‑air updates or software campaigns for your model year. Tesla, Rivian, Lucid and some Hyundai–Kia models lean heavily on OTA support; others still rely on dealer visits.

4. Local service and parts access

Map out the nearest brand‑authorized service center for the EV you’re considering. A bargain Lucid or niche import isn’t as attractive if the nearest service center is several states away.

5. Total cost of ownership

Beyond price, factor in warranty coverage, home‑charging install costs, likely insurance rates and potential out‑of‑warranty repairs. Different EV manufacturers have very different parts pricing.

Where Recharged comes in

How Recharged fits into the EV manufacturer landscape

As EV manufacturers in the USA diversify, the used market gets more complicated. At Recharged, the job is to make that complexity manageable. Rather than steering you toward one brand, the platform compares them side‑by‑side with transparent data, so you can decide which manufacturer, and which specific vehicle, fits your budget and driving pattern.

Shopping used EVs from different manufacturers with Recharged

How the experience changes when the data’s on your side.

Battery‑first evaluation

Whether it’s a Tesla Model 3, Chevy Blazer EV or Hyundai Ioniq 5, Recharged’s diagnostic process focuses on verified battery health, not just odometer miles.

Fair market pricing

Listings are benchmarked against current EV pricing trends, including how each manufacturer’s models typically depreciate, so you can see whether a given car or truck is priced fairly.

Nationwide digital experience

From financing and trade‑in to delivery, Recharged handles the process digitally and backs it with EV‑specialist support and an Experience Center in Richmond, VA if you want to see vehicles in person.

FAQ: EV manufacturers in the USA

Frequently asked questions about EV manufacturers in the USA

Bottom line for EV manufacturers in the USA

The U.S. EV market in 2025 is no longer a one‑brand show. Tesla still anchors the discussion, but GM, Ford, Hyundai–Kia, Rivian, Lucid and a wave of luxury imports now give American shoppers real choice in body style, price point and technology. For used‑EV buyers, that choice is both an opportunity and a challenge: you can find compelling values across many brands, but the homework is more complex than comparing trim lines on gas cars.

If you focus on battery health, charging access, service coverage and transparent pricing, the name on the decklid matters less than how the vehicle fits your life. That’s where a data‑driven marketplace like Recharged, with battery diagnostics, fair‑market pricing and EV‑specialist support, can turn a crowded roster of EV manufacturers in the USA into a clear, confident decision for your next car.