If you’re eyeing an American electric car in 2025, you’re stepping into one of the most hotly debated corners of the auto market. U.S. EV sales keep hitting records, yet headlines talk about cooling demand, shifting incentives, and political whiplash. This guide cuts through the noise with a reporter’s look at the data, the major American brands, and what all of it means if you’re shopping, especially if you’re considering a used EV.

Snapshot: US EV market right now

The state of the American electric car in 2025

American electric car market by the numbers

On paper, the American electric car story looks impressive: volumes are at record highs and nearly every major automaker now offers at least one battery-electric model. Underneath, it’s messier. Growth is coming, but it’s slower than early forecasts; average prices are still elevated; and interest has softened as incentives change and politics seep into showroom decisions.

A cooling, not collapsing, market

What actually counts as an “American” electric car?

Ask ten people what an American electric car is and you’ll get ten answers. Some point to the badge on the hood, Tesla, Ford, Chevy. Others care more about where the vehicle is built or where the jobs are. Policy adds another layer: federal incentives now hinge on North American assembly and domestic battery sourcing, not just brand nationality.

Brand & heritage view

- American badges: Tesla, Ford, Chevrolet, GMC, Cadillac, Jeep, Rivian, Lucid, Lincoln and others.

- These companies are headquartered in the U.S. and design most of their products here.

- For many shoppers, especially in truck and SUV country, that’s what “American” means.

Manufacturing & jobs view

- Several “foreign” brands build EVs in American factories, Hyundai, Kia, BMW, Volvo and others.

- Final assembly, battery components and critical minerals content now influence federal incentives.

- A vehicle can wear an American badge yet be less U.S.-made (by content) than some imports.

How to check how American your EV is

Major American EV players and flagship models

Who’s building American electric cars today?

From Silicon Valley startups to Detroit stalwarts, here are the key players and the vehicles you actually see on U.S. roads.

Tesla

Still the volume leader in U.S. EVs, though its share is eroding as competition grows.

- Model Y & Model 3: The workhorses, compact crossover and sedan that dominate U.S. EV registrations.

- Cybertruck: Polarizing but visible; reshaping expectations for electric pickups.

- Model X & S: Older, higher‑end nameplates that helped define the modern EV era.

Ford

Leveraging truck and Mustang loyalty to sell EVs to mainstream American buyers.

- F‑150 Lightning: Electric version of America’s best‑selling truck, aimed squarely at work and family use.

- Mustang Mach‑E: Crossover that borrows an iconic name to pull performance‑minded buyers into EVs.

- Explorer / Lincoln EVs: Crossovers and luxury models expanding Ford’s electric footprint.

General Motors

GM is rolling EVs across its brands using its Ultium platform.

- Chevy Equinox EV & Blazer EV: Mainstream crossovers, critical for volume growth.

- Cadillac Lyriq: Luxury SUV that’s become a breakout hit by segment standards.

- GMC Hummer EV & Chevy Silverado EV: Halo trucks showing what big, American EVs can do.

Startups and niche American EV brands

Smaller in volume, outsized in influence.

Rivian

Rivian’s R1T pickup and R1S SUV helped prove there’s demand for premium, adventure‑oriented American electric trucks.

- Focus on off‑road capability and over‑the‑air software.

- Expanding into smaller, more affordable models to broaden appeal.

Lucid & others

Lucid’s Air sedan plays at the high‑efficiency, luxury end of the market, while a wave of new entrants experiments with SUVs, commercial vans and niche performance EVs.

Volumes are modest, but these brands push technology and efficiency that often trickles into higher‑volume models later.

How policy and tax credits are shaping EV demand

No discussion of American electric cars in 2025 is complete without policy. Incentives that helped propel EV adoption in 2022–2024 have been dialed back or restructured. On October 1, 2025, federal purchase credits for new and used EVs expired, leading to an immediate drop in monthly sales and a scramble among automakers to adjust pricing and leasing offers.

Before October 2025

- Up to $7,500 federal credit for eligible new EVs.

- Up to $4,000 credit for qualifying used EVs, subject to income and price caps.

- Layered on top of state and utility incentives in places like California, Colorado and New Jersey.

After incentives expired

- New EV monthly sales fell sharply as transaction prices effectively jumped overnight.

- Automakers leaned harder on discounts, subsidized leases and 0% APR offers to keep factories humming.

- Shoppers face more complexity: instead of a clean tax credit, deals vary brand by brand and month by month.

Double‑check incentives before you buy

Charging in America: where electric cars actually plug in

Charging access is one of the biggest swing factors in American EV adoption. The picture is improving, but it’s uneven. Coastal metros and EV‑dense states like California and Washington have robust fast‑charging coverage; rural areas and parts of the South and Midwest lag behind. Meanwhile, automakers are rapidly adopting Tesla’s NACS connector, giving many non‑Tesla drivers access to the Supercharger network over the next few years.

Three main ways American EV drivers charge

Most owners rely on a mix, but one tends to dominate day‑to‑day life.

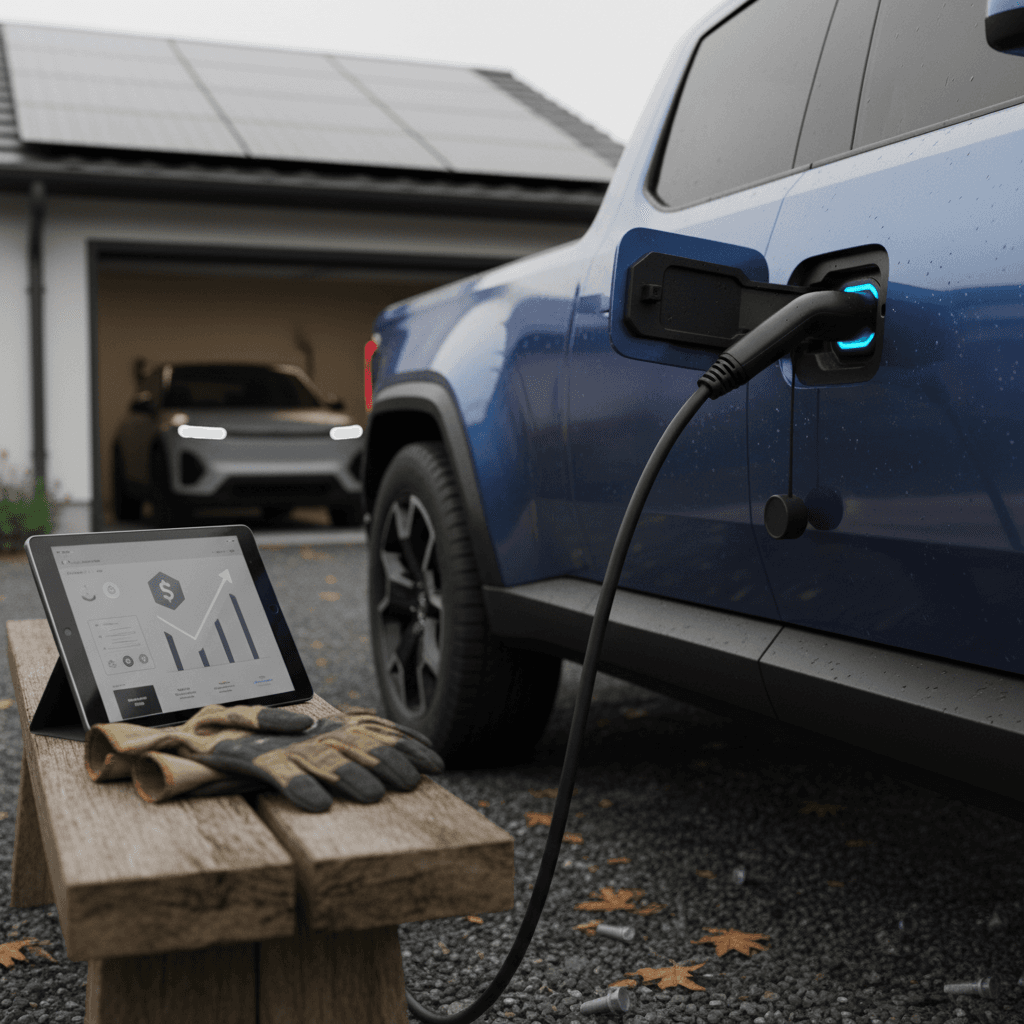

Home charging

- Most American EV miles start with a Level 2 home charger on a 240V circuit.

- Great fit if you own a home with off‑street parking.

- Electric rates and time‑of‑use plans heavily influence running costs.

Work & destination

- Workplace chargers and Level 2 stations at apartments, hotels and shopping centers fill in the gaps.

- Critical for renters and urban drivers who can’t install their own hardware.

Public DC fast charging

- Best for road trips and quick top‑ups, not daily use.

- Networks include Tesla Supercharger, Electrify America, EVgo, ChargePoint and utility‑backed regional players.

- Pricing varies widely, always check your app before plugging in.

Plan before you road‑trip

American electric car ownership: real‑world pros and cons

What owners tend to love

- Instant torque: Even mainstream American EVs feel quick around town.

- Low routine maintenance: No oil changes; fewer moving parts than ICE vehicles.

- Refueling at home: Starting every day with a "full tank" is a quietly transformative convenience.

- Quieter cabins: Especially noticeable in trucks and SUVs that used to be loud.

Where reality bites back

- Sticker shock: Even with dealer discounts, new EVs still command a premium over gasoline models.

- Charging gaps: Apartment and rural drivers often face real access problems.

- Cold‑weather range: Winter can shave 20–40% off effective range in northern states.

- Depreciation: Some early EVs took steep first‑owner losses, which helps used buyers but worries new‑car shoppers.

Why many Americans still switch

The rise of the used American electric car

Here’s where things get especially interesting for value‑minded shoppers. Rapid product cycles and earlier‑generation range anxiety pushed depreciation harder on some EVs than on comparable gas vehicles. For used‑car buyers, that’s created a window where you can buy an American electric car, often a Tesla, Ford, or GM product, for the price of a fairly ordinary new compact crossover.

At the same time, shoppers are getting smarter. The big question isn’t just mileage or trim level, it’s battery health. A 5‑year‑old EV with a well‑cared‑for pack can be a great deal; one with significant degradation or fast‑charging abuse is a tougher story. That’s why transparent diagnostics are becoming table stakes for serious used‑EV retailers.

Where Recharged fits in

How to shop smart for a used EV in the U.S.

Used American electric car buying checklist

1. Start with your daily use case

Be blunt about your needs. How many miles do you actually drive on a typical day? Do you have home or workplace charging? A realistic daily range target (after weather and degradation) should guide what you shop for.

2. Focus on battery health, not just mileage

Two vehicles with the same odometer reading can have very different battery stories. Look for a <strong>pack health report</strong>, state‑of‑charge data, and any history of fast‑charging vs. Level 2 use. This is where tools like the Recharged Score provide real value.

3. Verify charging port and connector

Most newer American EVs are shifting to the Tesla‑style NACS connector, while older models use CCS or J1772. Make sure the car you’re eyeing aligns with the public charging in your area, or budget for the appropriate adapters.

4. Check software and feature support

EVs are as much software as hardware. Confirm that key driver‑assist systems, over‑the‑air update support, and apps still work, and whether the previous owner kept the vehicle updated.

5. Review warranty and recall status

Battery and electric‑drive warranties often run longer than basic coverage. Verify what’s left on the clock, and check for completed or outstanding recalls, especially on early‑run EV models.

6. Compare total cost of ownership, not just price

Factor in insurance, electricity vs. fuel, maintenance, and any home‑charging installation costs. A slightly higher purchase price can still pencil out better over five to eight years.

Use specialized marketplaces to your advantage

Future outlook for American EVs

Looking out over the rest of the decade, forecasts still point to electric vehicles taking a steadily larger share of the U.S. market, even if the curve is bumpier than early evangelists predicted. Policy could swing again; tariffs and battery‑material sourcing rules will continue to shape pricing; and the pace at which charging expands outside major metros will influence adoption far from the coasts.

Two likely paths for American electric cars

If policy support returns or stabilizes

Reinstated or redesigned purchase incentives narrow the price gap between EVs and gas models.

Automakers keep rolling out mid‑priced American EVs rather than retreating to luxury segments.

Charging projects tied to federal and utility funding continue to expand corridor and urban coverage.

Used EVs benefit from higher new‑car demand and clearer residual‑value expectations.

If incentives stay limited and tariffs rise

New‑EV sticker prices remain a hurdle for mainstream buyers, especially in truck and SUV segments.

Automakers lean harder on leasing to mask costs and hit compliance targets where they exist.

Used American electric cars become the primary on‑ramp for budget‑conscious shoppers.

Brands with efficient manufacturing footprints in North America gain a cost advantage over import‑heavy rivals.

“The U.S. EV story isn’t a straight line. It’s a tug‑of‑war between cost, convenience, policy and culture, and that’s exactly what plays out every day on dealership lots and online marketplaces.”

American electric car FAQ

Frequently asked questions about American electric cars

The bottom line for American electric car shoppers

The American electric car market in 2025 is neither a runaway success nor a failed experiment, it’s a work in progress. Sales are at record highs, yet growth has cooled; incentives have shifted; and charging remains uneven. For shoppers, that creates more homework but also more opportunity, especially in the used market where early‑adopter depreciation has already been paid.

If you understand your driving pattern, charging options and budget, and insist on transparency around battery health, an American electric car can be a smart move, whether it wears a Tesla, Ford, Chevrolet, Rivian or Cadillac badge. And if you’d rather not decode this alone, platforms like Recharged exist to put hard data behind the story every used EV tells, from battery diagnostics and pricing to nationwide delivery and EV‑savvy support.