When people search for electric car companies in the USA, they’re really asking two questions: Who are the big players now, and which brands can I trust with my money and my daily life? In 2025, the US EV market is crowded, noisy, and changing fast, but with the right context, you can cut through the hype and make a smart choice, especially if you’re considering a used EV.

The short version

Snapshot of the US EV market

US EV market by the numbers

Don’t overreact to “EV slowdown” headlines

Major electric car companies in the USA

Let’s start with the companies that actually move volume in the US. These are the brands you’re most likely to see on the road, and on marketplaces like Recharged when you shop used.

Top EV players by US presence

What each major brand is really good at today

Tesla

Headquarters: Austin, TX (US‑based)

- Still the largest EV seller in the US with the Model 3 and Model Y.

- Runs its own Supercharger network, now opening to other brands.

- Software‑heavy cars with frequent over‑the‑air updates, and frequent feature churn.

On the used side, you’ll see lots of Model 3/Y with wide variation in battery health depending on how they were charged and driven.

Ford

Headquarters: Dearborn, MI

- Key EVs: Mache‑E, F‑150 Lightning, and E‑Transit vans.

- Strong appeal for truck and SUV buyers, with familiar Ford dealer support.

- Leaning into NACS (Tesla plug) and fast‑charging access.

Ford is still figuring out EV profitability, but they’re committed enough that parts and service support should be solid long‑term.

General Motors (GM)

Headquarters: Detroit, MI

- Key EVs: Chevrolet Equinox EV, Blazer EV, Cadillac Lyriq.

- Phasing out older Bolt tech, pivoting to its Ultium battery platform.

- Balancing EV investment with new spending on gas SUVs and trucks.

GM’s strategy has zig‑zagged, but Equinox EV and Lyriq are quickly becoming mainstream options in the US used and new markets.

Hyundai & Kia

Headquarters: Seoul, South Korea (sold heavily in US)

- Key EVs: Hyundai Ioniq 5/6, Kia EV6, EV9.

- Known for fast DC charging and strong design.

- Good warranty coverage, including battery guarantees.

For many shoppers, these are the pragmatic Teslas: quick, comfortable, and less drama.

Nissan

Headquarters: Yokohama, Japan (large US presence)

- Key EVs: Leaf (legacy), Ariya (newer crossover).

- Leaf defined the early US EV market, but its air‑cooled battery tech is aging.

- Ariya competes with Ioniq 5/EV6 but with slower charging.

Used Leafs can be extremely cheap, but battery health is everything, exactly the kind of thing Recharged’s Score Report is built to quantify.

Others worth noting

Several other global players sell EVs in meaningful US volumes:

- Volkswagen Group: VW ID.4, Audi Q4 e‑tron and others.

- Stellantis: Jeep, Chrysler and Dodge EVs arriving in 2025–27.

- Luxury brands: BMW i4/iX, Mercedes EQ series, Volvo/Polestar.

These brands lean heavily on existing dealer networks and tend to focus on higher‑margin, higher‑priced EVs.

Follow the service network, not just the badge

Foreign brands that dominate US EV sales

Not every important EV brand in the US is American. In fact, some of the most technically impressive EVs on US roads come from Korean and European manufacturers.

Hyundai–Kia: The charging speed kings

Hyundai’s E‑GMP platform (Ioniq 5/6) and Kia’s EV6/EV9 deliver some of the fastest DC fast‑charging in the mass market. They’re also early adopters of NACS, which means better access to US fast‑charging networks going forward.

For buyers who take a lot of road trips, this combination of speed and network access is worth as much as a few kWh of extra battery capacity.

Volkswagen, BMW, Mercedes, Volvo & Polestar

German and Scandinavian brands bring strong interiors, safety tech and driver‑assistance systems. The tradeoff is often higher prices and more complex options packaging.

If you’re shopping these brands used, pay extra attention to software update history and whether recalls and service campaigns have actually been completed.

Good news for US shoppers

American EV startups to watch

Beyond the big legacy players, several US‑based startups are trying to build the next generation of EVs. Some will succeed, some won’t, that uncertainty is the point.

Key US‑based EV startups

High ambition, higher execution risk

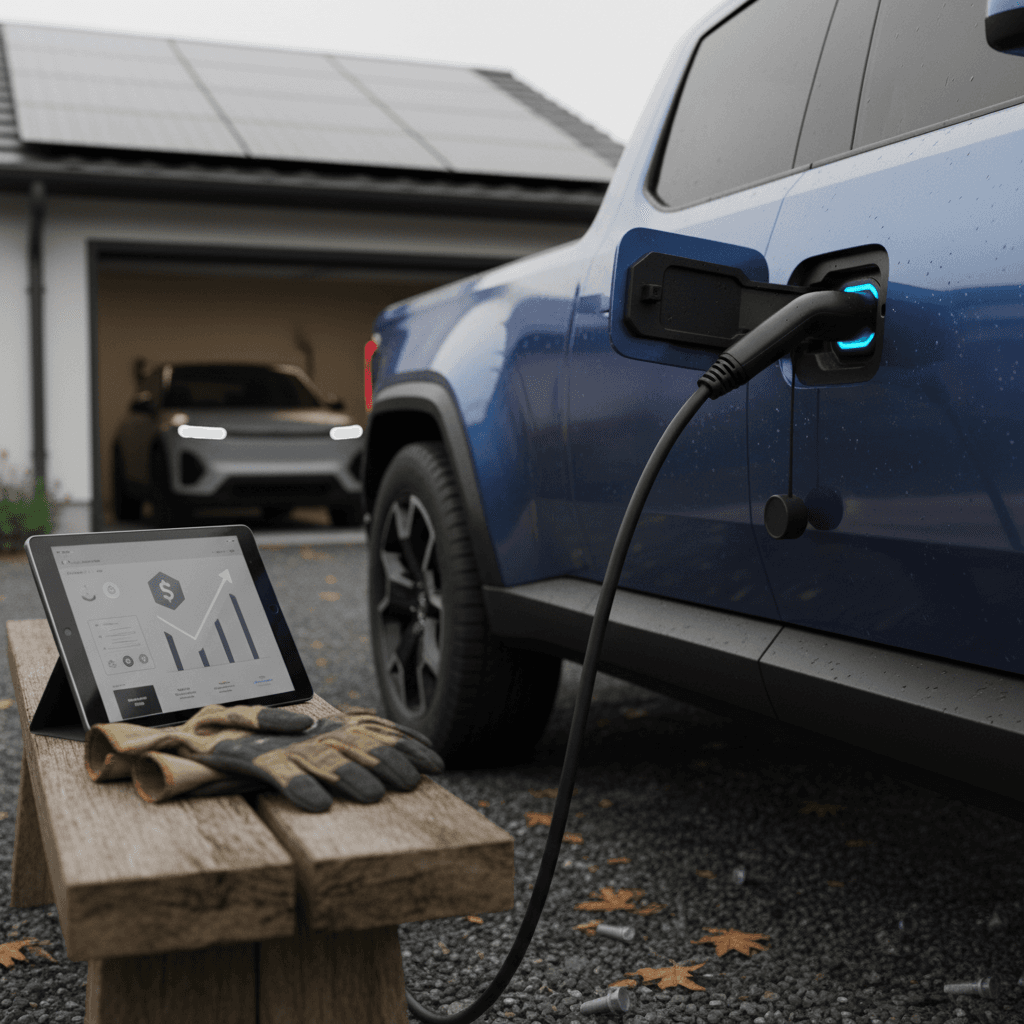

Rivian

Focus: Adventure‑oriented trucks and SUVs (R1T, R1S) and commercial vans.

- US‑based manufacturing in Normal, Illinois.

- Strong brand among outdoor and tech‑savvy buyers.

- Building its own charging network (Rivian Adventure Network) alongside public charging.

Rivian has real vehicles on the road and growing used inventory, but profitability remains a long‑term question.

Lucid

Focus: Ultra‑efficient luxury sedans and SUVs.

- Lucid Air is one of the most efficient and long‑range EVs sold in the US.

- Targets Tesla’s upper end and German luxury brands.

- Relies heavily on investor support while it scales.

Lucid’s tech is impressive, but as with any young brand, long‑term service coverage is something to think about when buying used.

Slate Auto

Focus: Compact, lower‑priced electric pickup.

- US startup based in Michigan with plans to build the Slate Truck in Indiana.

- Targets a starting price in the mid‑$20,000s for a simple, configurable work/play truck.

- Production is planned but not yet underway.

Like many early‑stage companies, Slate’s promise is big, and so is the execution risk.

Aptera

Focus: Ultra‑efficient, solar‑assisted three‑wheeler.

- Radically different layout focused on extreme efficiency.

- Plans for US production, but multiple delays and restarts.

- Appeals to early adopters more than mainstream buyers.

If you’re considering any pre‑production startup, treat deposits as speculative and don’t assume timelines will hold.

Startup risk is real

Side‑by‑side comparison of leading EV companies

Major EV brands selling in the USA

How key electric car companies stack up on price, coverage and risk, from a US shopper’s perspective.

| Brand | Country HQ | Typical Price Band (new) | US Service Footprint | Charging Strengths | Main Buyer Risk |

|---|---|---|---|---|---|

| Tesla | USA | Mid to upper‑mid | Company‑owned service centers; limited but focused | Wide Supercharger access, NACS native | Brand volatility; frequent product changes |

| Ford | USA | Mid, some premium | Very large dealer network | Adopting NACS; good BlueOval highway coverage | First‑gen EVs still maturing; software fit/finish varies |

| GM (Chevy/Cadillac) | USA | Mid to premium | Large dealer network | Ultium‑based models adopting NACS, growing fast‑charge access | Strategy shifts; earlier Bolt tech vs newer Ultium models |

| Hyundai–Kia | South Korea | Mid | Strong dealer coverage in most metros | Very fast DC charging, NACS transition underway | Some models limited by US incentives depending on build location |

| Nissan | Japan | Budget to mid | Long‑standing dealer network | Leaf depends on older CHAdeMO; Ariya on CCS/NACS | Leaf battery degradation on older cars; Ariya charging speed |

| Rivian | USA | Upper‑mid to premium | Growing service footprints, mobile service | Own Adventure Network plus public fast charging | Young company, long‑term residual values uncertain |

| Lucid | USA | Premium/luxury | Limited but expanding service centers | Strong efficiency; CCS now, NACS announced | Narrow audience; company viability still watched closely |

This table focuses on mainstream passenger EVs; commercial vehicles and low‑volume exotics aren’t listed.

How to choose the right EV brand for you

The real question behind “Which electric car companies in the USA are best?” is “Which brand fits your use case, risk tolerance and budget?” Here’s a structured way to think about it.

Step‑by‑step: Matching a brand to your life

1. Define your daily and worst‑case driving

Write down your typical daily miles and your longest regular trip. If you drive 35 miles a day and take a 300‑mile trip twice a year, you’ll prioritize different brands than someone doing 200‑mile commutes.

2. Map local service and charging

Before you fall in love with a badge, check where the nearest <strong>dealer or service center</strong> is, and what fast‑charging networks are strong in your region. In many parts of the US, that points you toward Tesla, Hyundai–Kia, Ford or GM.

3. Decide how much software experimentation you want

Tesla and some startups ship software like tech companies, rapid updates, new features, occasional glitches. Traditional automakers tend to move slower but more conservatively. Choose the culture that fits your appetite for change.

4. Consider resale and brand trajectory

Brands gaining share and expanding lineups (Hyundai–Kia, some GM models) tend to look safer for resale than brands retrenching or whose CEO is constantly in the headlines. Look for a clear, consistent EV roadmap.

5. For used EVs, focus on battery health first

Two identical EVs from the same brand can have very different battery health depending on fast‑charging, climate and usage. On Recharged, every car comes with a <strong>Recharged Score battery report</strong> so you’re not guessing.

6. Test real‑world ergonomics and charging workflow

Try plugging in, using the app, folding seats, loading cargo. A brand that looks great on paper can be exhausting in daily use if the UI is clumsy or charging is confusing.

Think network, not just vehicle

New vs. used EVs, and where Recharged fits

Once you understand the main electric car companies in the USA, the next decision is whether to buy new or used. In 2025, the used EV market is finally big enough that you can be choosy, and smart shoppers absolutely should be.

When a new EV makes sense

- You qualify for strong tax credits or lease deals that bring the payment close to a comparable gas car.

- You want the very latest driver‑assist tech and longest‑range packs from brands like Hyundai–Kia, Tesla, or GM.

- You’re planning to keep the car 8–10 years and value full warranty coverage.

If you’re chasing cutting‑edge fast‑charging or a specific new model (say, a just‑released Equinox EV trim), new can be rational, especially if you drive a lot.

Why used EVs are compelling in 2025

- Early‑adopter depreciation means 3–5‑year‑old EVs can be dramatically cheaper than new.

- Most major brands offer 8–10‑year battery warranties, so you may still have substantial coverage.

- You can benefit from the brutal price wars Tesla and others fought in 2023–24 without having lived through them.

The catch: you must understand battery health and charging history, which is exactly what most traditional used‑car channels gloss over.

How Recharged helps you pick the right car, not just the right brand

FAQ: Common questions about electric car companies in the USA

Frequently asked questions

Key takeaways for EV shoppers in the US

The landscape of electric car companies in the USA is far more diverse than it was even five years ago. Tesla still dominates, but Ford, GM, Hyundai–Kia, VW Group and a growing cast of startups are steadily chipping away, each with different strengths around pricing, charging, design and support. For you as a buyer, that competition is pure upside, as long as you stay clear‑eyed about brand risk and ecosystem health.

- Think in terms of ecosystems, not just nameplates: service, software and charging matter as much as specs.

- Be realistic about your driving and charging patterns before you fall in love with a specific brand.

- Treat startup brands as higher‑risk, higher‑reward plays, especially on the used market.

- If you’re buying used, elevate battery health and verified history over shiny options or paint colors.

- Use data, not vibes: platforms like Recharged give you battery diagnostics, fair‑market pricing and EV‑specialist guidance so you can make a rational, confident call.