When people talk about electric car suppliers, they often mean very different things: the brands on the badge, the battery makers behind the scenes, or the companies building motors, chips, and charging tech. If you’re trying to buy, finance, or sell an EV in 2025, understanding who supplies what can tell you a lot about pricing, long‑term reliability, battery health, and resale value, especially in the fast‑moving used EV market.

Quick definition

Why electric car suppliers matter to everyday buyers

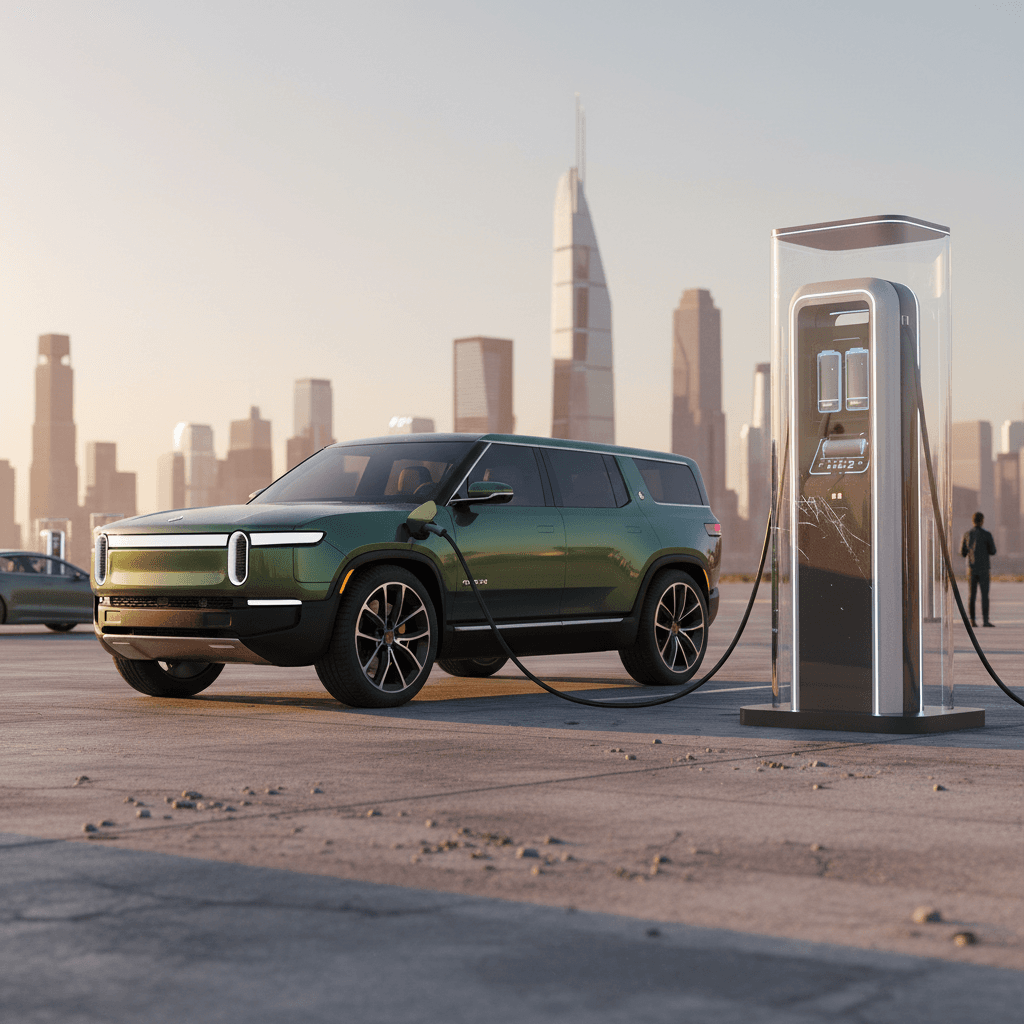

For new EVs, the supplier conversation usually starts and ends with the brand: Tesla, Hyundai, Ford, Volkswagen, and so on. But the modern EV is as much about batteries and software as sheet metal. A vehicle sourced from a strong supply base, reputable battery maker, stable semiconductor pipeline, and established charging partnerships, tends to age better, hold value longer, and be easier to live with day to day.

- Battery supplier affects range, charging speed, and how quickly the pack may degrade over time.

- Automaker strategy determines over‑the‑air updates, warranty support, and whether the model is likely to be supported 8–10 years from now.

- Supply chain stability influences whether parts are easy to get and how painful recalls or software bugs might be.

Used EV angle

The three layers of electric car suppliers

1. Vehicle manufacturers

These are the badges you recognize, Tesla, BYD, Hyundai, Ford, GM, Volkswagen, BMW and others. They design the vehicle platform, integrate the powertrain and software, manage safety compliance, and provide warranty support.

2. Battery suppliers

Specialist firms like CATL, BYD, LG Energy Solution, SK On, Samsung SDI, Panasonic, and others produce the cells and packs that define range, charging behavior, and longevity.

3. Component & software suppliers

This includes everything from inverters and motors to ADAS sensors and infotainment, often sourced from Tier 1 suppliers such as Bosch, Continental, Aptiv, plus in‑house code from the automaker.

Don’t overcomplicate it

Top electric car suppliers by brand in 2025

Globally, the list of leading EV brands has shifted quickly. Chinese players have surged, while legacy automakers are still scaling up. For U.S. shoppers, though, availability and incentives still tilt heavily toward a mix of domestic and allied‑market suppliers.

Major EV brands and their positioning

What the big electric car suppliers are known for in 2025

Tesla

Role: Global BEV benchmark with huge software and charging advantage.

- Approx. 1.79M battery‑electric vehicles delivered in 2024.

- Models 3/Y dominate U.S. used EV listings.

- Heavy vertical integration including in‑house motors, software, and some batteries.

BYD

Role: Massive Chinese player with vertical integration from cells to cars.

- More than 4.27M vehicles sold in 2024, including hybrids.

- Blade Battery tech is shaping safety and cost benchmarks.

- Not yet in the U.S. retail market, but influential globally.

Hyundai–Kia

Role: Aggressive global EV supplier on E‑GMP platform.

- Ioniq 5/6, EV6, and new crossovers are fast‑charging standouts.

- Strong presence in U.S. and Europe; building North American battery plants.

Other important electric car suppliers

Legacy automakers finding their EV footing

General Motors

Ultium platform underpins Cadillac Lyriq, Chevy Blazer EV, Equinox EV and others.

Partnerships with LG Energy Solution for Ultium Cells plants in the U.S. aim to localize battery supply and meet tax‑credit rules.

Nissan & Renault group

Nissan pioneered mass‑market EVs with the Leaf and is pushing a new wave of models under its “Arc” strategy, targeting lower battery costs and higher global EV mix by 2030.

Volkswagen Group & others

Volkswagen, BMW, Mercedes‑Benz, Stellantis, and others are scaling up EVs with varying speed. Many rely heavily on CATL, LG, Samsung SDI, and regional battery joint ventures.

What this means for buyers

Leading EV battery suppliers and why they dominate

If you zoom in on the supply chain, the most powerful electric car suppliers in 2025 aren’t automakers at all, they’re battery companies. Global EV battery usage reached roughly 894 GWh in 2024, and a short list of firms delivered most of it.

Global EV battery leaders in 2024

Major EV battery suppliers and key customers

A simplified look at who powers whom. Exact pairings can vary by model and region.

| Battery supplier | Approx. 2024 global share | Notable automaker customers | Key chemistries |

|---|---|---|---|

| CATL | ~38% | Tesla, BMW, Mercedes-Benz, Volkswagen, many Chinese brands | LFP, NMC |

| BYD | ~17% | BYD-branded vehicles, selected external OEM projects | LFP (Blade), NMC |

| LG Energy Solution | ~11% | GM (Ultium), Hyundai–Kia, Tesla (some plants), others | NCMA, NMC |

| SK On | ~4–5% | Ford, Hyundai–Kia, Volkswagen (some models) | NCM |

| Panasonic | ~4% | Tesla (especially older U.S. models), Toyota alliances | NCA, NCM |

| Samsung SDI, CALB, Gotion & others | Low‑to‑mid single digits each | European, Korean, and Chinese OEMs | NMC, LFP and emerging chemistries |

Key EV battery suppliers and their notable automotive customers as of 2024–2025.

LFP vs NMC in plain English

How suppliers shape price, range, and reliability

Once you know who the electric car suppliers are, you can start to see patterns in how vehicles are priced, how they drive, and how they age. A compact hatchback on an LFP pack from a cost‑focused Chinese supplier will behave differently from a luxury crossover running high‑nickel chemistry from a Korean or Japanese partner.

Three big ways suppliers affect your experience

What you’ll notice as an owner, not just in spec sheets

1. Purchase price & incentives

Automakers with strong local battery partnerships can hit price points that qualify for more tax credits and incentives in markets like the U.S. That can shave thousands off the effective price of a new EV, and indirectly support the used market as more vehicles enter the fleet.

2. Range & charging behavior

Battery chemistry and supplier engineering dictate how quickly you can charge, how performance holds in cold weather, and how usable the last 20% of the pack feels. Tesla–Panasonic or Tesla–CATL pairings behave differently from early‑generation packs in first‑wave EVs such as the Nissan Leaf.

3. Degradation & reliability

Well‑engineered packs plus robust battery management systems generally degrade more slowly. That’s critical in used EV shopping: a 5‑year‑old car from a top‑tier supplier can hold 85–90% of its original range, while a similar‑age model with marginal thermal management may have lost far more.

Where Recharged comes in

Supply-chain risks, tariffs, and policy shifts

Electric car suppliers don’t operate in a vacuum. Policy, trade disputes, and incentives can change the economics of EVs almost overnight. The U.S., for example, has leaned on federal tax credits and battery‑sourcing rules to encourage local manufacturing and reduce dependence on Chinese cells.

Tariffs and regional sourcing

Tariffs on Chinese EVs and batteries have nudged suppliers to build more capacity in North America and Europe. Korean firms like LG Energy Solution, SK On, Samsung SDI, plus joint ventures with GM, Ford, Stellantis, and others, are racing to meet local‑content rules.

For buyers, this can change which models qualify for full or partial federal tax credits, and over time, it should support a more resilient local supply base.

Technology bets & consolidation

Beneath the big names, dozens of smaller EV startups and suppliers are under pressure. Rapid price cuts, especially from Chinese brands, are squeezing margins and triggering consolidation. The survivors will be the suppliers with scale, strong technology, and stable customers.

That’s another reason used shoppers often gravitate toward vehicles backed by large, diversified groups that are likely to be around a decade from now.

Watch the orphan risk

How to factor suppliers into a used EV purchase

In the used market, you’re not negotiating with CATL or Panasonic directly. But the choices those companies made years ago, chemistry, cooling strategy, pack layout, show up in battery health, charging predictability, and resale values. That’s why serious used‑EV shoppers increasingly treat supplier information as part of the due‑diligence process.

Marketplaces like Recharged sit right at this intersection. By focusing exclusively on used EVs, running battery diagnostics, and surfacing fair‑market pricing, they effectively translate a complex web of electric car suppliers into a simple score and narrative for each vehicle.

Supplier questions to ask when buying used

These go beyond the usual test‑drive checklist

Who built the battery and how is it aging?

Look for diagnostics, not just odometer miles. On Recharged, the Recharged Score highlights battery state‑of‑health, charging history patterns, and any warning signs tied to a specific supplier or pack generation.

How does the brand treat older EVs?

Check whether the automaker is still issuing over‑the‑air updates, honoring warranty campaigns, and supporting fast‑charging improvements for older vehicles. A supplier that keeps investing in its EV fleet can boost both safety and resale value.

Checklist: Evaluating an EV by its suppliers

Practical checklist for electric car suppliers

1. Identify the battery supplier

Look up whether the vehicle uses cells from CATL, LG Energy Solution, Panasonic, BYD, or another major player. Many enthusiast forums, automaker documentation, and third‑party reports will note this by model and year.

2. Confirm chemistry (LFP vs NMC/NCA)

Chemistry influences range, charging, and cold‑weather behavior. LFP packs often appear in standard‑range variants and ride‑share oriented models; NMC/NCA usually underpin long‑range and performance trims.

3. Review real battery health data

Don’t rely on guesses. Ask for a recent battery diagnostic. On Recharged, every listing includes a <strong>Recharged Score battery report</strong> so you can compare vehicles apples‑to‑apples.

4. Check brand commitment to EVs

Scan recent news and product plans. Is this supplier adding EV models and building new plants, or quietly trimming its lineup? A shrinking EV program can be a yellow flag for long‑term support.

5. Assess charging ecosystem support

Consider whether the automaker supports common standards (NACS, CCS), offers robust navigation to chargers, and participates in large public networks. This is as much a software question as a hardware one.

6. Look at total cost of ownership

Battery supplier reputation, available tax credits on newer models, and expected degradation all feed into depreciation and operating costs. Use that context when weighing a lightly used EV against a cheaper, older one.

FAQ: Common questions about electric car suppliers

Frequently asked questions about electric car suppliers

The bottom line: What matters most for you

The world of electric car suppliers is crowded and complex, but you don’t need to be a supply‑chain analyst to make a smart decision. Focus on the big pieces: a committed automaker, a reputable battery supplier, and clear evidence of how that specific pack has aged. In 2025, that often means looking past the badge and into the battery report.

Whether you’re trading in a gas car, cross‑shopping brands, or zeroing in on a specific model, it pays to have an ally that understands the EV supply chain. Recharged was built for exactly that, offering verified battery health diagnostics, transparent pricing, financing, trade‑in options, and nationwide delivery so you can choose the right used EV with confidence, no spreadsheet required.