Search for EV companies in 2025 and you’ll see everything from Tesla stock chatter to niche battery startups you’ve never heard of. If you’re just trying to understand which companies actually matter when you buy, own, or sell an electric car, especially a used one, the noise can be overwhelming.

Big picture

Why EV companies matter more than ever in 2025

EV market snapshot, January–August 2025

The EV market has moved from early adopters to the early‑majority stage. Tens of millions of electric vehicles are already on the road, and EV companies are figuring out which business models actually work at scale. For you as a driver, that means more choice, but also more fragmentation in charging standards, software, and long‑term support.

Why this matters for used EVs

The 5 types of EV companies you should know

The EV ecosystem at a glance

Five categories that shape your day‑to‑day ownership experience

1. EV automakers

Companies that design and build EVs or plug‑in hybrids.

- Examples: Tesla, BYD, Hyundai, Volkswagen

- What it affects: driving experience, safety, features, brand support

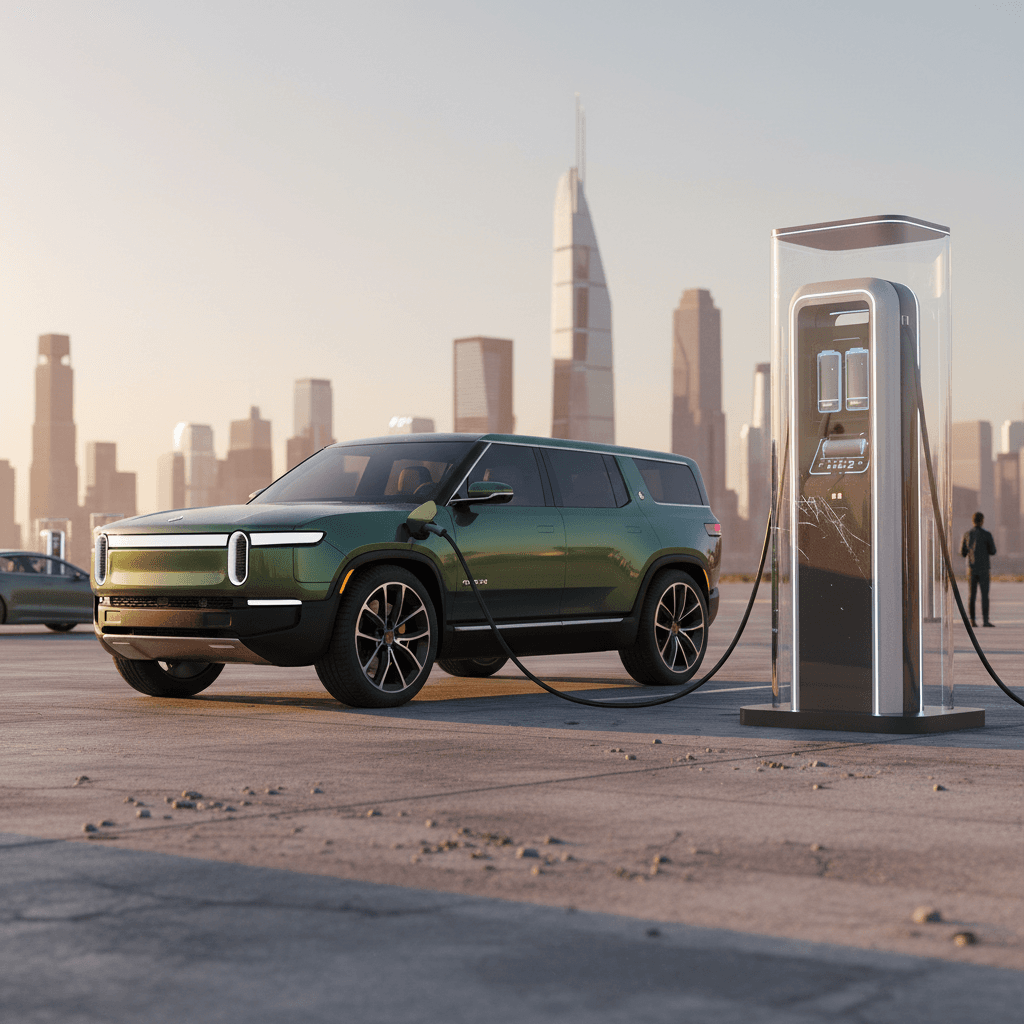

2. Charging networks

Companies that deploy public fast and Level 2 chargers.

- Examples: Tesla Supercharger, Electrify America, EVgo

- What it affects: road trips, convenience, charging costs

3. Battery manufacturers

Companies that make the cells and packs inside your EV.

- Examples: CATL, LG Energy Solution, Panasonic, BYD

- What it affects: range, durability, safety

4. Software & platforms

Companies that provide navigation, charging apps, and telematics.

- Examples: OEM software teams, Android Automotive, charging apps

- What it affects: route planning, reliability, energy costs

5. Retail & resale platforms

Companies that change how you buy, sell, and finance EVs.

- Examples: Recharged (used EV marketplace), online retailers, captive finance arms

- What it affects: pricing transparency, financing, trade‑in value

6. Policy & grid partners

Not companies, but critical players.

- Utilities, regulators, grid operators

- What it affects: incentives, home charging rates, reliability

How to use this guide

Top EV automakers in 2025

Let’s start with the companies actually building the vehicles. Below are the major EV automakers shaping today’s market, along with what matters if you’re thinking about buying one of their cars, especially used.

Leading global EV automakers (early 2025)

High‑level view of the automakers that dominate global EV sales and mindshare.

| Group | Home country | EV position | What they’re known for | Used‑buyer considerations |

|---|---|---|---|---|

| BYD | China | Global EV volume leader | Huge range of affordable EVs and plug‑in hybrids, strong battery tech in‑house | Great efficiency and value; watch import availability and service coverage in the U.S. |

| Tesla | United States | Top global BEV seller | Supercharger network, software‑centric design, over‑the‑air updates | Excellent fast‑charging access; pay attention to build quality and battery health on high‑mileage cars. |

| Geely (incl. Volvo/Polestar) | China | Fast‑growing EV group | Mix of premium (Volvo, Polestar) and value brands, strong in Europe and China | Good safety and comfort; software maturity and dealer EV expertise vary by brand. |

| Volkswagen Group | Germany | Legacy giant going electric | VW ID. series, Audi, Skoda, Cupra expanding EV lineups | Dealer experience ranges widely; check software update history on earlier MEB models. |

| SAIC | China | Mass‑market and joint ventures | MG‑branded EVs in Europe and other markets | Attractive pricing; check local service support and parts availability. |

| Hyundai–Kia | South Korea | High‑regarded modern EVs | E‑GMP platform (Hyundai IONIQ 5/6, Kia EV6) with fast charging and strong design | Often excellent used value; battery and charging performance generally strong. |

| Stellantis | Europe/US | Multi‑brand electrification | Jeep, Peugeot, Fiat, and others adding EVs and PHEVs | Product quality improving; ensure local dealers are comfortable servicing EVs. |

| BMW Group | Germany | Premium EV segment | i4, iX, and newer models focus on refinement and performance | Premium pricing; software and charging performance generally solid but network depends on region. |

These groups differ a lot in product mix, some are all‑in on EVs, others still sell mostly gasoline cars.

Automakers with strong used EV appeal

US‑based EV companies to know

- Tesla – Still the reference point for BEV range, charging access, and software. The lineup (Model 3, Y, S, X, Cybertruck) dominates used EV supply in many U.S. markets.

- GM – Ultium‑based EVs like the Chevy Blazer EV, Equinox EV, and Cadillac Lyriq are finally arriving in meaningful volumes, and GM is pivoting to the NACS charging standard.

- Ford – Mustang Mach‑E and F‑150 Lightning combine familiar branding with EV tech; Ford’s EV sales have been growing steadily and it’s also adopting NACS.

- Rivian – Adventure‑oriented R1T and R1S plus the smaller R2 on the way; strong product, still scaling up service and charging partnerships.

- Lucid – High‑efficiency, luxury sedans and SUVs; excellent range and performance, but resale and service depend heavily on the company’s long‑term scale.

What about smaller EV startups?

Key EV charging companies and networks

Charging is where most EV companies either delight drivers or lose them. A good car paired with a bad charging experience can feel like a bad car. So it’s worth knowing who runs the plugs you rely on.

Major public charging companies (U.S.‑centric view)

The charging brands you’re most likely to encounter, either directly or via roaming agreements.

| Company / network | Type | Key markets | Notable traits | Used‑buyer angle |

|---|---|---|---|---|

| Tesla Supercharger | DC fast + some Level 2 | Global, very dense in U.S., Europe, China | Historically closed; now opening to non‑Tesla EVs via NACS and adapters | Owning an EV with NACS access can dramatically improve road‑trip convenience and resale appeal. |

| Electrify America | DC fast, some Level 2 | Primarily U.S. | Wide‑spaced highway coverage, mixed reliability reputation, upgrading hardware | Important for CCS‑equipped non‑Tesla EVs on road trips, check real‑world reviews for your routes. |

| EVgo | DC fast | Urban U.S. markets plus key corridors | Focus on cities and partnerships with GM and Pilot truck stops | Useful for apartment dwellers who rely on public urban fast charging. |

| ChargePoint | Mostly Level 2, some DC fast | U.S. and Europe | Network of hardware sold to site hosts, experience varies by location | Great for workplace and destination charging; quality depends on who maintains each site. |

| Regional utilities & fleets | Mix of Level 2 and DC fast | Varies by state/region | Electric utilities, retailers, and fleets adding chargers | Good to know what your local utility offers, rates can be attractive for frequent users. |

Availability, reliability, and connector standards are more important than sheer charger counts.

Follow the connector, not just the logo

Battery manufacturers powering today’s EVs

Battery companies rarely show up in glossy ads, but they’re central to how an EV ages. Different chemistry choices and suppliers lead to big differences in range retention, fast‑charging comfort, and safety margins over 8–15 years.

Major EV battery manufacturers

These companies supply the cells or packs inside many of today’s EVs

CATL (China)

Contemporary Amperex Technology Co. is the world’s largest EV battery maker by market share.

- Supplies: Tesla (some models), BMW, Hyundai–Kia, and many Chinese brands

- Known for: LFP and high‑nickel chemistries, cost and scale

BYD (China)

BYD is both an automaker and a major battery producer.

- Blade Battery design prioritizes packaging efficiency and safety

- Increasingly supplies other automakers as well

LG Energy Solution (Korea)

Key supplier to GM, Hyundai–Kia, and others.

- Deep involvement in North American cell plants

- History includes some recalls but newer chemistries are more robust

Panasonic (Japan)

Long‑time partner to Tesla in North America.

- Building large U.S. plants to support domestic EV production

- Strong on cylindrical cell manufacturing

Samsung SDI & SK On

Other Korean giants supplying European and U.S. automakers.

- Often used in premium and high‑performance EVs

- Investing heavily in solid‑state R&D

Recyclers & second‑life firms

Not cell makers, but critical to the ecosystem.

- Companies like Redwood Materials focus on materials recovery

- Influences long‑term sustainability and future battery costs

Why battery chemistry matters

Software, retail, and data: the hidden EV companies

Under the hood, EVs are software‑defined products on wheels. That shifts power toward companies that excel at software updates, route planning, and data‑driven services, and toward retailers that make sense of all this for buyers.

Software & digital platforms

Modern EVs depend on always‑connected software stacks, for battery management, driver assistance, infotainment, and charging logic.

- Automaker software teams ship over‑the‑air updates that can change range estimation, charging curves, and even acceleration.

- Navigation & charging apps (both built‑in and third‑party) determine how confidently you plan long trips.

- Data platforms aggregate fleet data to predict battery health and optimize energy usage.

Retail & used‑EV specialists

Buying a used EV is not the same as buying a used gas car, battery health and charging access are far more important.

- Recharged focuses specifically on used EVs, pairing every car with a Recharged Score Report and verified battery diagnostics.

- Digital‑first platforms can surface comparable pricing and battery health data that traditional dealerships aren’t set up to provide.

- End‑to‑end online journeys plus expert EV support make switching to electric much less intimidating.

Where Recharged fits in

What all of this means if you’re buying a used EV

So how do these EV companies translate into concrete decisions when you’re looking at a used Tesla Model 3 versus a Hyundai IONIQ 5 versus a Chevy Bolt EUV? It comes down to three pillars: ecosystem stability, charging access, and battery confidence.

1. Ecosystem stability

Is the automaker financially healthy and committed to EVs? Are their dealers or service centers ready to work on electric powertrains? Do they have a roadmap for software and connectivity support?

A brand with a shrinking EV program or unstable finances can make long‑term ownership riskier, even if the car looks like a bargain today.

2. Charging access

Can your EV access reliable fast charging on the routes you actually drive? Is it NACS‑native or reliant on adapters and CCS networks that may change over time?

Look at your specific region: urban vs rural, apartment vs home charging, frequent road trips vs mostly local driving.

3. Battery confidence

Who built the battery, how is it cooled, and what’s its track record? Has the pack been fast‑charged heavily? Are there known recalls or software updates that affect range?

This is where data‑driven diagnostics, like the Recharged Score Report, are far more useful than a generic “it feels fine on a test drive.”

Don’t treat all used EVs as equal

Checklist: how to evaluate EV brands as a buyer

Used EV buyer’s checklist for EV companies

1. Map your charging reality first

Before falling in love with a brand, check which fast‑charging networks cover your regular routes and destinations. Favor EVs that can use those networks easily, ideally with a native NACS port or widely supported adapters.

2. Research automaker commitment

Look at each brand’s EV roadmap, not just today’s models. Are they expanding EV offerings, investing in new platforms, and selling meaningful volumes, or treating EVs as a compliance afterthought?

3. Understand the battery supplier and chemistry

If possible, identify whether the car uses LFP or nickel‑rich chemistries and which company built the pack. Ask how this chemistry tends to age and how it likes to be charged.

4. Check recall and software‑update history

Search for battery‑related recalls, charging‑curve changes, or range‑estimation updates. Cars that have received major battery‑management updates may behave differently than early reviews suggest.

5. Get objective battery health data

Use a platform that can measure real battery health rather than relying on a dashboard range guess. At Recharged, every car comes with a <strong>Recharged Score</strong> based on diagnostic testing, not just a visual inspection.

6. Evaluate service and parts support

Can you reasonably get the car serviced locally? Are parts back‑ordered for months? Call a dealer or independent EV shop and ask how comfortable they are working on the model you’re considering.

7. Consider resale and demand

Look at how similar used EVs from the same automaker have held value. Strong ecosystems and charging access typically translate into healthier resale markets.

FAQ about EV companies in 2025

Frequently asked questions about EV companies

The future of EV companies, and what to watch next

The EV story in 2025 is no longer just “Tesla versus the world.” It’s a complex ecosystem where automakers, charging networks, battery suppliers, software platforms, and retailers all compete to shape your everyday experience behind the wheel. Some EV companies are scaling up sustainably; others are discovering the hard way that building and supporting millions of connected battery‑powered cars is very different from launching a buzzworthy prototype.

If you’re shopping for a used EV, the safest strategy is to think in ecosystems. Favor brands with strong charging access, top‑tier battery partners, and clear long‑term software support. Use objective diagnostics, like the Recharged Score Report, to cut through marketing claims and see how a specific car’s battery has really aged.

As EV adoption accelerates through the late 2020s, the companies that win won’t just be the ones that ship the most cars. They’ll be the ones that make owning an EV genuinely simple for normal drivers, transparent pricing, dependable charging, honest battery information, and straightforward support when something goes wrong. That’s the world Recharged is working toward every day.