If you’re shopping for an electric car today, you’re not just choosing a model, you’re choosing among very different electric vehicle makers with very different track records. Tesla still dominates headlines, but Chinese brands like BYD have surged, and legacy automakers from Ford to Hyundai are racing to catch up. Understanding who’s actually leading, and what that means for resale value, charging, and reliability, can save you real money on your next EV, especially if you’re buying used.

A quick note on "EV makers"

Why electric vehicle makers matter to you

When you’re comparing electric vehicles, it’s tempting to focus only on price, range, and styling. But the brand behind the car matters just as much. The company’s financial health, software support, charging partnerships, and battery strategy all affect your ownership experience, and your car’s value when you go to sell or trade in.

Three ways EV makers shape your ownership experience

Think beyond the window sticker price.

Charging access

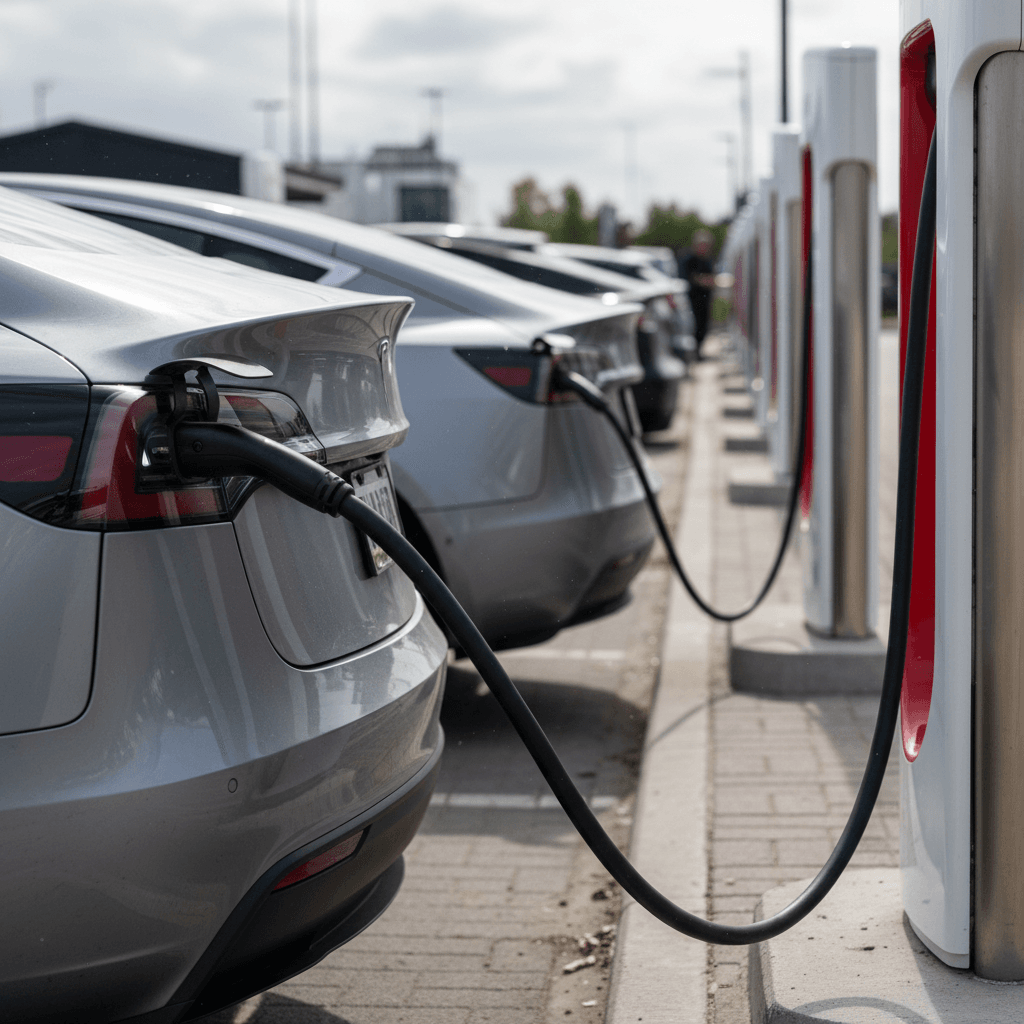

Automakers are aligning with fast‑charging networks and connector standards. Tesla’s NACS plug is becoming the default in North America, and more brands are signing on.

Battery tech & warranty

Some makers design their own batteries and offer strong degradation warranties, while others rely on suppliers and older chemistries that may age differently.

Resale & brand strength

Brands investing seriously in EVs tend to hold value better. Thin model lineups and slow software updates can hurt resale when you’re ready to move on.

Shopping used?

Global EV market 2025: who’s actually leading?

Global plug‑in market snapshot, 2025

On a global basis, the center of gravity has shifted decisively toward China. BYD and a cluster of other Chinese groups now account for a huge slice of worldwide EV sales, while Tesla remains the most visible pure‑EV brand in the U.S. At the same time, legacy automakers are ramping up production, often on shared platforms that underpin several models.

Top global plug‑in EV groups in 2025 (Jan–Aug deliveries)

A high‑level look at which automaker groups are shipping the most plug‑ins worldwide.

| Group | Home market | 2025 deliveries* | Approx. share | Key EV brands |

|---|---|---|---|---|

| BYD | China | 2.6M | ~20% | BYD, Denza, Fangchengbao |

| Geely Group | China | 1.3M | ~10% | Geely, Volvo, Polestar, Zeekr, Lynk & Co |

| Tesla | United States | 0.99M | ~8% | Tesla |

| Volkswagen Group | Europe | 0.85M | ~7% | VW, Audi, Skoda, Cupra, Porsche |

| SAIC | China | 0.72M | ~6% | SAIC, MG, Wuling (with GM) |

| Changan | China | 0.56M | ~4% | Changan, Deepal |

| Hyundai–Kia | South Korea | 0.42M | ~3% | Hyundai, Kia, Genesis |

| Chery | China | 0.40M | ~3% | Chery, Exeed, Jetour |

| BMW Group | Europe | 0.39M | ~3% | BMW, Mini |

| Stellantis | Europe/US | 0.34M | ~3% | Jeep, Peugeot, Opel, Fiat, Citroën |

Figures rounded; includes BEVs and PHEVs where applicable.

Watch the definitions

Pure EV specialists: Tesla, BYD and other focused players

Tesla: still the reference point in the U.S.

Tesla remains the best‑known electric vehicle maker in North America, thanks to its early start, vertically integrated approach, and Supercharger network. In 2024 it delivered just under 1.8 million battery‑electric vehicles worldwide and still leads global BEV sales, even as growth has slowed and competition has intensified.

- Strengths: Mature fast‑charging network in North America, strong software and over‑the‑air updates, relatively simple model lineup, robust used‑market demand.

- Watch‑outs: Price swings, variable build quality on some older vehicles, and more competition eroding resale advantage in certain markets.

BYD: the volume king, especially in China

BYD has quietly become the world’s largest producer of plug‑in vehicles by volume, pairing in‑house batteries with aggressive pricing. In 2024 it sold more than 4 million plug‑in passenger vehicles globally, including roughly 1.76 million BEVs and an even larger number of PHEVs.

- Strengths: Own battery tech (including LFP packs), wide price coverage from budget to premium, fast growth in overseas markets.

- Watch‑outs: Limited U.S. presence so far, ongoing tariff and trade uncertainty, and unknown long‑term resale performance outside China.

Other notable EV‑focused makers

You’ll mostly see these brands in specific regions or niches, but they’re worth knowing.

Rivian

U.S. startup focused on adventure‑oriented trucks and SUVs. Strong software, excellent ride quality, but smaller service and charging footprint than legacy brands.

Lucid

Luxury sedan and SUV maker emphasizing efficiency and range. High price points and limited dealer/service coverage keep volumes low.

Nio, XPeng & others

Chinese EV specialists with advanced tech and attractive pricing in their home market. Limited direct presence in the U.S. today, but influential globally.

Legacy automakers going electric: Ford, GM, VW, Hyundai and more

Traditional manufacturers may have been late to the EV party, but they bring deep pockets, existing factories, and dealer networks that can ease the transition for many buyers. Some now offer full EV lineups in key segments, while others are still in early innings.

How major legacy automakers approach EVs

Same goal, very different playbooks.

Ford & GM (United States)

Ford leans on recognizable nameplates (F‑150 Lightning, Mustang Mach‑E) and is pivoting to more affordable EVs after a slower‑than‑hoped rollout.

GM is standardizing on its Ultium platform across brands (Chevrolet, Cadillac, GMC, Buick) with a wide range of SUVs and trucks in the pipeline.

Volkswagen Group & Stellantis (Europe/US)

Volkswagen Group is investing heavily in dedicated EV platforms and battery plants across Europe and North America.

Stellantis (Jeep, Peugeot, Opel, Fiat and others) is electrifying popular small cars and crossovers, with more plug‑in Jeeps and compact BEVs arriving.

Hyundai–Kia (South Korea)

Hyundai and Kia have quickly become favorites among EV reviewers thanks to fast‑charging architectures, efficient motors, and competitive pricing on models like the Ioniq 5, Ioniq 6, EV6 and EV9.

Toyota, Honda & others (Japan)

Toyota has long focused on hybrids but is rolling out more pure EVs as regulations tighten.

Honda is partnering with other automakers and tech companies to bring competitive EVs to market later in the decade.

Dealer network can still matter

Rising EV makers to watch

Beyond the headline names, several smaller electric vehicle makers are shaping the market through technology, design, or value. As a shopper, you’ll see some of these brands more often in used listings over the next few years.

- VinFast: Vietnamese automaker expanding aggressively into North America and Europe with SUVs at various price points. Early vehicles drew mixed reviews, but later updates have addressed some concerns.

- Fisker (legacy and new attempts): Several EV efforts under the Fisker name have come and gone. If you’re eyeing one used, pay extra attention to parts and service support.

- Leapmotor & Aion: Chinese EV brands focused on value and younger buyers, increasingly partnering with larger groups for overseas expansion.

- Premium newcomers: Low‑volume luxury EVs from brands like Lotus, Maserati, and others may show up in used listings; they can offer thrills but may be costly to maintain.

Be careful with orphan brands

Chinese electric vehicle makers and U.S. shoppers

China is the world’s largest EV market, and Chinese manufacturers are now among the top electric vehicle makers globally. But their presence in the U.S. remains limited due to tariffs, politics, and brand‑awareness challenges. That’s slowly changing as Chinese‑built EVs arrive under familiar Western badges and as brands like BYD expand into Mexico, Latin America, and Europe.

Chinese brands in disguise

You might already be driving Chinese EV tech without realizing it. Joint ventures and platform sharing mean brands like Volvo, Polestar, and MG rely heavily on Chinese manufacturing and engineering, even if the name on the nose is European.

- Some U.S.‑market EVs are assembled in China and imported.

- Others use battery packs sourced from Chinese suppliers.

- Still others share platforms with Chinese‑market models.

Tariffs, politics, and future availability

High U.S. tariffs on Chinese‑built vehicles and ongoing trade tensions are throttling direct imports. That’s one reason you don’t see rows of BYD or Nio models at American dealers yet.

For used buyers, this means most of the Chinese EVs you’ll see in U.S. listings will carry familiar badges, or arrive via niche importers, at least for now.

How the maker affects your used EV purchase

When you buy a used EV, you’re not choosing between a “good” brand and a “bad” brand. You’re weighing trade‑offs: software support versus purchase price, battery tech versus interior quality, charging access versus dealer familiarity. That’s where a structured approach pays off.

Questions to ask about the maker before you buy

1. How serious is this brand about EVs?

Look at the breadth of its electric lineup and investment in charging partnerships. A maker with a clear long‑term EV roadmap is more likely to keep improving software and supporting older vehicles.

2. What’s the battery warranty and track record?

Most brands offer 8–10 years of battery coverage, but real‑world degradation can vary by chemistry and thermal management. Search for owner reports by brand and model year.

3. How strong is the service and parts network?

An EV‑only startup with just a handful of service centers can be a challenge if you live far away. A legacy brand might have many dealers, but fewer truly EV‑savvy techs. Ask specifically about EV training and parts availability.

4. How does the car charge in the real world?

Does the maker support modern fast‑charging standards like NACS in North America? Are software updates improving charging curves over time or throttling older packs?

5. What’s resale like for this brand?

Look at 3‑ to 5‑year‑old used prices. Steep drops aren’t always bad, they can mean great deals, but they do signal how the market feels about a maker’s long‑term prospects.

Where Recharged fits in

Battery health, brand, and the Recharged Score

Battery behavior is one of the biggest differences among electric vehicle makers, and one of the hardest for individual shoppers to evaluate. Even within a single brand, chemistry and cooling strategies change over time. That’s why objective diagnostics matter more than badge loyalty.

How different EV makers approach batteries

Same goal, very different engineering choices.

In‑house battery makers

Brands like BYD and, increasingly, Tesla design or produce many of their own packs. That can offer tighter integration and cost control, but it also means changes can be rapid from one model year to the next.

Supplier‑based strategies

Groups like Volkswagen, Hyundai–Kia, Ford, and GM source cells from several suppliers and integrate them into their own packs. Chemistry may differ by region or trim, even within a single model line.

What the Recharged Score adds

Instead of guessing based on the badge, a Recharged Score uses direct battery diagnostics, driving data, and thermal history, so you can compare two used EVs from different makers on a level playing field.

Don’t over‑generalize by brand

Quick comparison of major electric vehicle makers

At‑a‑glance view of popular EV makers for U.S. shoppers

This table focuses on how brands typically look from a used‑buyer’s perspective in late 2025. Individual models can differ.

| Maker/group | Region focus | Charging access | Battery reputation* | Value on used market |

|---|---|---|---|---|

| Tesla | Global, strong U.S. | Excellent (native Supercharger + NACS) | Generally strong; some early variability | Usually strong, softening as competition grows |

| BYD | China, expanding globally | Good in home markets; limited U.S. | Solid LFP tech; limited U.S. data | Great value overseas; scarce in U.S. |

| Hyundai–Kia | Global | Strong DC fast‑charge capability, NACS support announced | Efficient packs, good fast‑charge behavior | Often strong thanks to long warranties |

| Volkswagen Group | Europe, China, U.S. | Growing access; NACS adoption coming for North America | Mixed early reports, improving with newer platforms | Varies by brand; VW ID models often good value |

| Ford | U.S. & Europe | Rapidly improving via NACS and network deals | Reasonable early results, still limited history | Attractive pricing on used F‑150 Lightning & Mach‑E |

| GM (Chevrolet, Cadillac, etc.) | U.S. & global | Transitioning to NACS and partner networks | New Ultium packs still building track record | Good value where incentives applied heavily |

| Rivian | U.S. first | Own network plus NACS adoption roadmap | Limited long‑term data but promising so far | Holds value well in niche adventure segment |

"Charging access" reflects U.S. network integration and NACS adoption; "Value on used market" is relative within each class.

About that battery reputation note

Checklist: choosing the right EV maker for you

Brand choice can feel emotional, but a little structure helps cut through the noise. Use this checklist to narrow your short‑list to a few electric vehicle makers that actually fit your life.

Practical steps to pick the right EV maker

1. Start with your use case, not the badge

List your real needs: commute length, road‑trip frequency, home‑charging situation, passengers, cargo. Then map those needs to segments (small crossover, three‑row SUV, pickup) before you fixate on a brand.

2. Pick 2–3 makers that cover your segment well

If you need a family crossover, for example, that might mean short‑listing Tesla, Hyundai–Kia, and Volkswagen Group rather than trying to track the whole market.

3. Compare charging and software, not just range

A slightly shorter‑range EV from a maker with better fast‑charging and smarter route planning can be easier to live with than a long‑range model on a weaker network.

4. Look at 3–5 year total cost of ownership

Include purchase price, likely depreciation for that brand, expected energy costs, and maintenance. Used EVs from fast‑depreciating makers can offer excellent value if the battery checks out.

5. Get an independent battery health report

Before you commit to any used EV, regardless of maker, insist on objective battery data. With Recharged, every vehicle already includes a Recharged Score with verified battery diagnostics.

Electric vehicle makers FAQ

Frequently asked questions about electric vehicle makers

The bottom line for EV shoppers

In a market this dynamic, there’s no single “best” electric vehicle maker, only brands that are a better or worse fit for your budget, charging situation, and risk tolerance. Tesla, BYD, and a handful of legacy groups are setting the pace, while newer players push innovation at the edges. Your job is to narrow the field to a few serious candidates, then judge the actual vehicles on their merits.

If you’re leaning toward a used EV, that’s where Recharged can tilt things in your favor. By pairing brand‑level perspective with a data‑driven Recharged Score Report for every car, we help you see past the badge to the battery, the pricing, and the real‑world condition. That way, whichever electric vehicle maker you choose, you’ll know you’re getting a car, and a deal, that makes sense for the long haul.