Stand in any traffic jam in 2025 and you’ll see the story instantly: Teslas nose-to-tail with BYDs, Hyundai IONIQs, Volkswagen IDs, the occasional Rivian truck shouldering past like an REI store on wheels. Electric vehicle manufacturers aren’t a niche sideshow anymore, they are the main act, and who builds your car now dictates everything from charging options to resale value.

Two markets, one driveway

Why electric vehicle manufacturers matter more than ever

Picking an EV in 2025 isn’t just about color and monthly payment. The manufacturer’s strategy determines whether your car uses Tesla’s NACS charging plug or CCS, how fast it charges, what software updates it gets, and how that battery holds up when the odometer clicks past 80,000 miles. It also sets the tone for reliability, dealer experience, and how much your car is worth when you’re ready to sell or trade.

- Charging access and speed: your brand choice dictates which fast‑charging networks you can use comfortably on a road trip.

- Software and updates: Tesla, Hyundai, Rivian and others treat cars like rolling smartphones; others still think in model-years.

- Battery durability: some manufacturers have a track record of gentle degradation; others… less so.

- Resale value: shopper demand tends to cluster around a handful of trusted names in the used market.

Used EV shoppers: watch the badge

Global EV leaders at a glance

Global EV manufacturers by market share, 2025 snapshot

On the world stage, EV manufacturing has become a three‑act play. Act I is China, with BYD, Geely, SAIC, Changan and others flooding their domestic market and increasingly Europe and Latin America. Act II is the U.S., where Tesla dominates but now faces a serious charge from GM, Ford and startups. Act III is Europe and South Korea, where Volkswagen Group, BMW, Mercedes‑Benz, Hyundai and Kia build EVs that feel tailor‑made for buyers who still love the idea of a traditional car, just without the gasoline.

Major electric vehicle manufacturers by group

A simplified look at the big automotive groups shaping the EV landscape in 2025.

| Group | Home base | EV strength in 2025 | Examples you’ll actually see used in the U.S. |

|---|---|---|---|

| BYD | China | Global volume leader, aggressive pricing, strong batteries | Limited U.S. presence (for now); influences pricing for everyone |

| Tesla | United States | Best‑selling BEV brand, software and charging ecosystem leader | Model 3, Model Y, Model S, Model X |

| Geely (incl. Volvo/Polestar) | China/Sweden | Growing global share, design‑forward brands | Volvo XC40/XC60 Recharge, C40, Polestar 2 |

| Volkswagen Group | Germany | Strong in Europe; wide portfolio across brands | VW ID.4, Audi Q4 e‑tron, Porsche Taycan (high‑end) |

| SAIC & partners | China | Budget‑friendly EVs in Asia and Europe | Chevy‑badged joint‑venture models in some markets |

| Hyundai Motor Group | South Korea | Highly efficient platforms, standout design | Hyundai IONIQ 5/6, Kona Electric; Kia EV6, Niro EV |

| Stellantis | Europe/U.S. | Catches up with compact EVs and vans | FIAT 500e, Jeep Wagoneer S (emerging), some plug‑in hybrids |

| GM | United States | Ultium platform ramping; strong trucks and crossovers | Chevy Blazer EV, Equinox EV, Cadillac Lyriq, Chevy Bolt (used) |

| Ford Motor Company | United States | Truck/SUV focused; NACS adoption underway | Mustang Mach‑E, F‑150 Lightning |

| BMW Group | Germany | Premium EVs with familiar BMW driving feel | BMW i4, iX, i5, Mini Cooper SE |

Figures combine battery‑electric and plug‑in hybrids where groups report them together.

Tesla: the brand that made EVs mainstream

Love it or loathe it, Tesla turned the electric car from science project into status symbol. In 2024 it was still the world’s best‑selling pure battery‑electric automaker, with roughly 18% of global BEV sales and more than 1.7 million vehicles delivered. In the U.S., even after recent slowdowns, Tesla still accounts for close to half of all EV sales.

Tesla’s EV manufacturer profile

What you feel from behind the wheel, and in your wallet.

Strengths

- Charging access: Industry‑leading Supercharger network, increasingly open to other brands.

- Efficiency: Strong range per kWh on most models.

- Software: Frequent over‑the‑air updates keep even older cars feeling current.

Weaknesses

- Build quality can be inconsistent compared to German and Japanese rivals.

- Interior design is minimalist to a fault for some buyers.

- Service availability can lag in some regions.

What it means used

- High brand recognition supports resale values.

- Battery management has been generally good; degradation tends to be gradual when cared for.

- Earlier cars may lack today’s safety or driver‑assist refinements, check the spec sheet closely.

Recharged & Tesla

Chinese EV manufacturers: BYD, Geely and the new powerhouses

The most important EVs in the world right now may be the ones you can’t yet buy at your local U.S. dealer. BYD, Geely (including Volvo and Polestar), SAIC, Changan and others are flooding China and parts of Europe with well‑equipped, aggressively priced EVs. Between January and August 2025, BYD alone delivered about 2.6 million plug‑in vehicles, nearly 20% of the global market.

BYD: the quiet giant

- Vertically integrated, BYD builds its own batteries, electronics and many components.

- Known for its "Blade" LFP battery, engineered for durability and fire resistance.

- Dominant in China; rapidly expanding into Europe, Latin America and other regions.

Geely, SAIC & friends

- Geely controls Volvo and Polestar, giving it instant credibility in the West.

- SAIC focuses on value, often with joint‑venture models.

- Brands like NIO, XPeng and Li Auto push software, autonomy and luxury angles.

U.S. shoppers: mind the import politics

European EV manufacturers: Volkswagen, BMW, Mercedes and more

Europe’s automakers watched Tesla storm into their home turf and responded with a blizzard of their own EVs. Volkswagen’s ID family, BMW’s i‑series and Mercedes‑Benz’s EQ lineup all aim to deliver an electric car that still feels like the brand you grew up aspiring to drive.

How key European EV manufacturers stack up

Three different flavors of Old World electrification.

Volkswagen Group

- Mass‑market focus with VW ID.3/ID.4/ID.7 in Europe and ID.4 in the U.S.

- Premium offerings via Audi, Porsche and others.

- Historically conservative interiors; improving software with each generation.

BMW Group

- Performance‑oriented EVs like the i4 and i5 still feel like BMWs to drive.

- Interior quality and ergonomics are excellent.

- Range and efficiency are good, though not class‑leading.

Mercedes‑Benz

- Comfort and quiet are the main event, especially in EQS and EQE.

- Complex infotainment can polarize shoppers.

- Premium pricing but strong brand cachet on the used market.

European EVs on the U.S. used market

American and Korean brands: Ford, GM, Hyundai, Kia, Rivian, Lucid

If Tesla and BYD are the headline acts, the most interesting character actors are coming from Detroit and Seoul. GM and Ford are racing to electrify trucks and SUVs, while Hyundai and Kia quietly build some of the best‑driving, most efficient EVs you can buy today. In the wings, Rivian and Lucid play the roles of adventurous startup and luxury technocrat, respectively.

Brand‑by‑brand snapshots

Ford

Mustang Mach‑E and F‑150 Lightning bring familiar nameplates into the EV era. Ford has committed to Tesla’s NACS connector, which will simplify long‑distance charging for owners over the next few years.

General Motors

Ultium‑based EVs like the Cadillac Lyriq and Chevy Blazer EV are finally arriving in volume. Early software snags are smoothing out, but used‑market shoppers should pay close attention to recall and update histories.

Hyundai

The IONIQ 5 and 6, plus Kona Electric, offer standout efficiency, design that looks beamed in from 2030, and very fast DC charging on 800‑volt platforms.

Kia

The EV6 and EV9 mix bold styling with genuinely useful range and family‑friendly interiors. As with Hyundai, charging performance is a major selling point.

Rivian

The R1T pickup and R1S SUV are lifestyle vehicles with serious off‑road credibility. Earlier builds had teething issues; hardware updates and a growing service network have improved things, but due diligence is key when buying used.

Lucid Motors

The Air sedan chases range records and S‑Class levels of comfort. Volumes are low and the company is still in prove‑it mode, so used buyers should approach as they would an exotic: eyes open, warranty paperwork in hand.

“The EV market in 2025 isn’t a duel; it’s a crowded starting grid. For buyers, that’s the good news, more choice, more competition, and better cars at lower prices.”

Legacy vs. startup EV manufacturers: what changes for you

One of the biggest questions shoppers ask is whether to trust a century‑old manufacturer just learning EVs or a startup built around them from day one. Each camp has real advantages and trade‑offs, and the right answer depends more on your risk tolerance than on any spec sheet.

Legacy manufacturers (Toyota, VW, Ford, GM, BMW, etc.)

- Pros: Established dealer and service networks, parts supply, and familiarity for most technicians.

- Often better build quality and cabin refinement.

- Deep experience with safety engineering and crash performance.

- Cons: Some models feel "ICE cars turned electric", packaging and software can lag dedicated EV players.

Startup‑focused EV brands (Tesla, Rivian, Lucid, NIO abroad)

- Pros: Cleaner EV‑first platforms, forward‑looking software, and charging ecosystems designed around daily app use.

- Fresh design language and experimentation with interiors.

- Cons: Limited service footprint, evolving reliability records, and more volatility in long‑term parts and support.

Support risk is real

How manufacturers shape prices and resale values

Electric cars don’t depreciate evenly. Brand reputation, battery technology and the speed of model updates all shape what your EV will be worth three, five or eight years down the road. The result is a used market where a five‑year‑old Tesla Model 3 may command more money than a newer, lesser‑known rival with similar specs.

What brand does to your EV’s value

This is where a neutral, third‑party lens becomes powerful. At Recharged, every vehicle on the marketplace includes a Recharged Score Report that blends verified battery diagnostics with market data. That means a Chevy Bolt, Tesla Model Y and Hyundai Kona Electric can be judged on the same playing field instead of just on badge prestige.

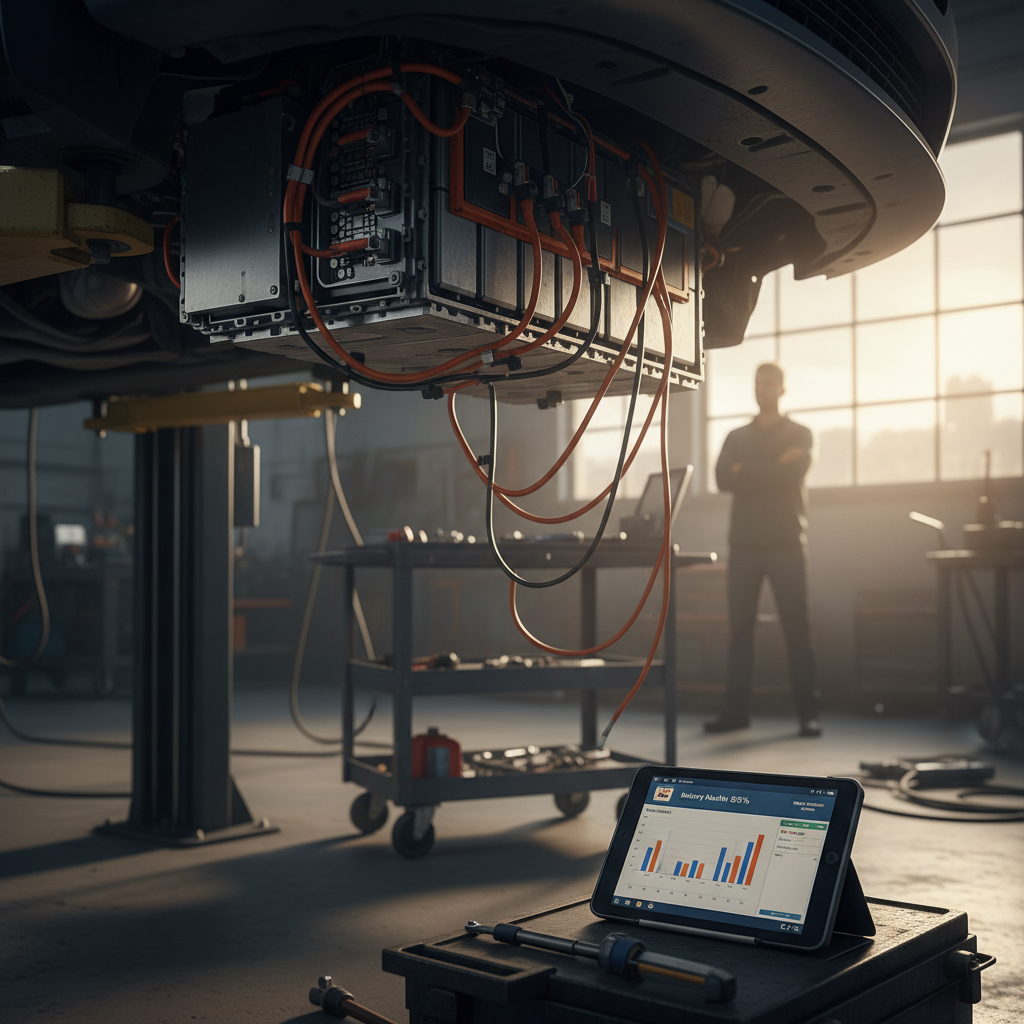

Battery tech, warranties, and why the Recharged Score matters

Ask any engineer: the real manufacturer in an EV is the battery. Carmakers that treat batteries as a core competency, BYD, Tesla, Hyundai‑Kia, BMW, tend to deliver better long‑term range retention and more consistent fast‑charging performance. Others are still learning the ropes, sometimes the hard way, via recalls and software throttling.

How manufacturers differ on batteries

Three factors that matter when you’re shopping used.

Chemistry choices

- LFP batteries (common in BYD, some Teslas, some Fords) trade a bit of energy density for longevity and tolerance for frequent fast charging.

- NMC batteries offer more range per pound but can be more sensitive to heat and repeated DC fast charging.

Warranty coverage

- Most major EV manufacturers offer 8‑year battery warranties, often with a mileage cap.

- Read the fine print: some promise a minimum state of charge (e.g., 70% capacity) while others are more vague.

Real‑world health

- Not all 8‑year‑old batteries are equal. Climate, charging habits and software updates all matter.

- Recharged’s Score Report uses direct diagnostics to show actual health, not just what the dash display claims.

Why diagnostic reports beat guesswork

How to choose an EV brand that actually fits your life

The temptation is to sort electric vehicle manufacturers into winners and losers. The smarter move is to sort them into fits me and doesn’t. A city commuter with home charging has a very different set of needs from a sales rep doing 30,000 highway miles a year, or a family looking to replace their minivan with something that doesn’t smell faintly of spilled milk.

Quick checklist: matching manufacturer to your use case

1. Start with charging, not horsepower

If you road‑trip often, prioritize brands that support reliable, high‑power DC fast charging and Tesla’s NACS plug, Tesla itself, plus Ford, GM, Hyundai, Kia and others transitioning to the standard.

2. Consider the service map

Zoom out on a map and look at where the manufacturer has service centers or partnered dealers. Tesla, Hyundai/Kia, Ford, GM, VW and BMW have good U.S. coverage; newer startups may not.

3. Decide how much you value software polish

If you care about slick apps and over‑the‑air improvements, Tesla, Rivian and Hyundai/Kia tend to impress. If you prefer conventional controls and dealer‑performed updates, traditional brands may feel more comfortable.

4. Think about resale horizon

Planning to keep the car 10 years? Battery durability and warranty matter more than brand cachet. Planning to sell in 3–4? Focus on manufacturers with strong used demand, Tesla, Hyundai/Kia, VW, some luxury Europeans.

5. Look beyond the logo

Use tools like the <strong>Recharged Score</strong> to compare battery health, price fairness and ownership costs across brands. A less glamorous badge with a healthier pack can be the smarter buy.

FAQ: electric vehicle manufacturers

Frequently asked questions about EV manufacturers

Closing thoughts on EV manufacturers in 2025

The story of electric vehicle manufacturers in 2025 is messy in the best possible way. No single brand has everything figured out, which means the era of one obvious, default EV choice is over. Instead you get a crowded, competitive field where Chinese scale, American software bravado, European refinement and Korean efficiency all battle for your driveway.

For you as a driver, that complexity is an opportunity. It means you can pick an EV that fits your life, your commute, your road trips, your appetite for risk, rather than settling for whatever happens to exist. And if you’re shopping used, platforms like Recharged turn the alphabet soup of electric vehicle manufacturers into something legible: clear battery health, fair pricing, EV‑savvy financing and expert guidance from the first search to the driveway handoff.

In other words, the question isn’t "Which manufacturer is best?" It’s "Which one is best for you, at this moment, in this market?" Answer that well, and the badge on your next EV becomes less a tribal affiliation and more a simple, satisfying choice.