Thinking about an EV car lease instead of buying your next electric vehicle? You’re not alone. As prices rise and incentives shift, more shoppers are trying to lower their monthly payment without getting stuck with long-term battery risk. In this guide, we’ll walk through how EV leasing works in 2025, what changed with federal tax credits, real-world lease examples, and when you’re usually better off leasing vs buying new or used.

Big picture

Why an EV car lease is on so many shopping lists

EV car lease market at a glance (U.S.)

For many drivers, an EV lease has been the easiest way to try an electric car without committing to long-term technology or resale risk. Automakers have used subsidized leases to move inventory, and until September 30, 2025, lenders could tap a $7,500 federal commercial EV credit and often pass some of that value into your payment. That landscape is changing, but the basic reasons people lease, lower upfront cost, flexibility, and protection from rapid depreciation, are still very much in play.

How an EV car lease actually works

1. The building blocks of an EV lease

Every EV car lease payment is built from a few key pieces:

- MSRP / selling price: The starting price of the vehicle (and how much the dealer discounts it).

- Residual value: What the lender predicts the EV will be worth at the end of your lease (often 50%–65% of MSRP for 24–36 months on popular models).

- Money factor: The interest rate equivalent used for your lease (multiply by 2,400 for an approximate APR).

- Lease term & miles: Common terms are 24–36 months and 10,000–12,000 miles per year.

2. What makes EV leases different

On paper, EV leases work just like gas-car leases. The twist is how fast EV values can move and how incentives layer on top:

- Residual risk: New EV prices and used values can swing quickly as technology improves and incentives come and go. Leasing pushes that risk onto the lender instead of you.

- Incentives: Automaker “lease cash” and, until fall 2025, federal tax credits often made leases far cheaper than financing the same EV.

- Battery confidence: Many shoppers like the idea of handing the car back before the battery ever leaves its original warranty window.

Quick rule of thumb

What changed in 2025: tax credits and EV leases

Through September 30, 2025, many EV car leases quietly benefited from the federal $7,500 commercial clean vehicle credit. Lenders could claim that credit and, when they chose to pass it through, use it to lower your capitalized cost and your monthly payment. A separate $7,500 credit for new EV purchases and $4,000 credit for used EVs also helped buyers. A new tax-and-spending package that took effect at the end of September wiped out those federal credits for most new and used EV shoppers, including for leases.

Key timing change

- Some automakers bumped EV lease prices soon after federal support expired, especially brands that had been passing nearly the full $7,500 into lease deals.

- Others, including major U.S. brands, temporarily kept aggressive lease cash in place on in-stock EVs to avoid a sudden drop in showroom traffic.

- State and utility incentives still exist in many markets, but many of those are rebates or bill credits, not lease-specific subsidies.

The takeaway: the era of universally subsidized EV leasing is fading. There are still strong deals out there, but you have to hunt for them and assume they may be shorter-lived or limited to specific trims, mileages, and ZIP codes.

Current EV car lease deals: what your money buys

EV lease offers move month to month, but recent deals from mainstream brands show the ballpark. Here’s a simplified snapshot of the kinds of offers shoppers have seen in 2025 on new EVs from volume manufacturers:

Sample 2025 new EV car lease offers (illustrative)

These examples reflect widely advertised manufacturer offers in 2025; your local terms, incentives and eligibility will vary.

| Model (2025 or 2024) | Term / miles | Advertised payment | Due at signing | Notes |

|---|---|---|---|---|

| Hyundai Ioniq 6 SE Std Range | 24 mo / 12k mi/yr | Around $169–$209/mo | ~$3,999 | Short terms with heavy lease cash; some offers bundled a free Level 2 charger or charging credit. |

| Hyundai Kona Electric | 24 mo / 12k mi/yr | Around $179–$189/mo | ~$3,999 | Often paired with low APR or bonus cash on purchases. |

| Honda Prologue AWD EX | 24–36 mo, varies | High-$100s to low-$200s/mo | Low-$3,000s | Aggressive conquest offers in ZEV states targeting non-luxury trade-ins. |

| Kia EV6 Light Long Range | 24 mo / 10k–12k mi/yr | Around $300–$360/mo | ~$3,999 | Stackable loyalty and competitive-owner cash could sweeten real-world deals. |

| Mainstream compact EV (e.g., VW ID.4, Nissan Ariya) | 24–36 mo / 10k–12k mi/yr | $150–$300/mo | $1,000–$5,000 | Effective cost depends heavily on regional incentives and dealer inventory. |

Always check the fine print: most low advertised payments assume excellent credit, specific trims, and limited annual mileage.

Advertised vs. actual cost

Pros and cons of an EV car lease

EV car lease: the good and the bad

Use this as a quick gut-check before you dive into the numbers.

Key advantages of leasing an EV

- Lower upfront cost: You usually put less money down than buying, and you’re only paying for depreciation plus fees and finance charges.

- Technology turnover: Upgrading every 2–4 years means you benefit from improvements in range, charging speed, and driver-assist tech.

- Battery risk off your plate: If future resale values fall because of faster-than-expected battery degradation or new tech, that’s the lender’s problem, not yours.

- Tax and incentive simplicity: Instead of claiming your own tax credit (where applicable historically), the incentive is already baked into the lease price when lenders decide to pass it through.

Main drawbacks of an EV lease

- No ownership or equity: When the lease ends, you hand the EV back unless you choose to buy it at the residual price.

- Mileage limits: Going over 10,000–15,000 miles per year can trigger per-mile penalties, which add up quickly if you drive a lot.

- Wear-and-tear charges: Scratches, dings, curb rash and worn tires at turn-in can generate extra bills.

- Less flexible in life changes: Breaking a lease early, for a move, job change or new family situation, can be expensive compared with selling a financed car.

EV lease vs buy (new vs used)

The real question isn’t just “Should I get an EV car lease?” It’s, “Does leasing beat financing a new EV, or buying a used one?” The answer depends on how long you keep cars, how many miles you drive, and how comfortable you are with battery and resale risk.

Lease a new EV

- Best if you like a new vehicle every 2–4 years.

- Good for early adopters who want the latest range and tech.

- Shifts resale and battery value risk to the lender.

- Watch mileage caps if you drive more than ~12,000 miles per year.

Finance a new EV

- Build equity if you plan to own 6–10 years.

- Works well if you’re confident about long-term EV costs and your driving patterns.

- Higher monthly payment than a comparable lease, but you end up with an asset.

- At today’s rates, stretching to 72–84 months can lower the payment but raises total interest cost.

Buy a used EV

- Lets someone else eat the steepest depreciation.

- Great if you want the lowest total cost of ownership over 5+ years.

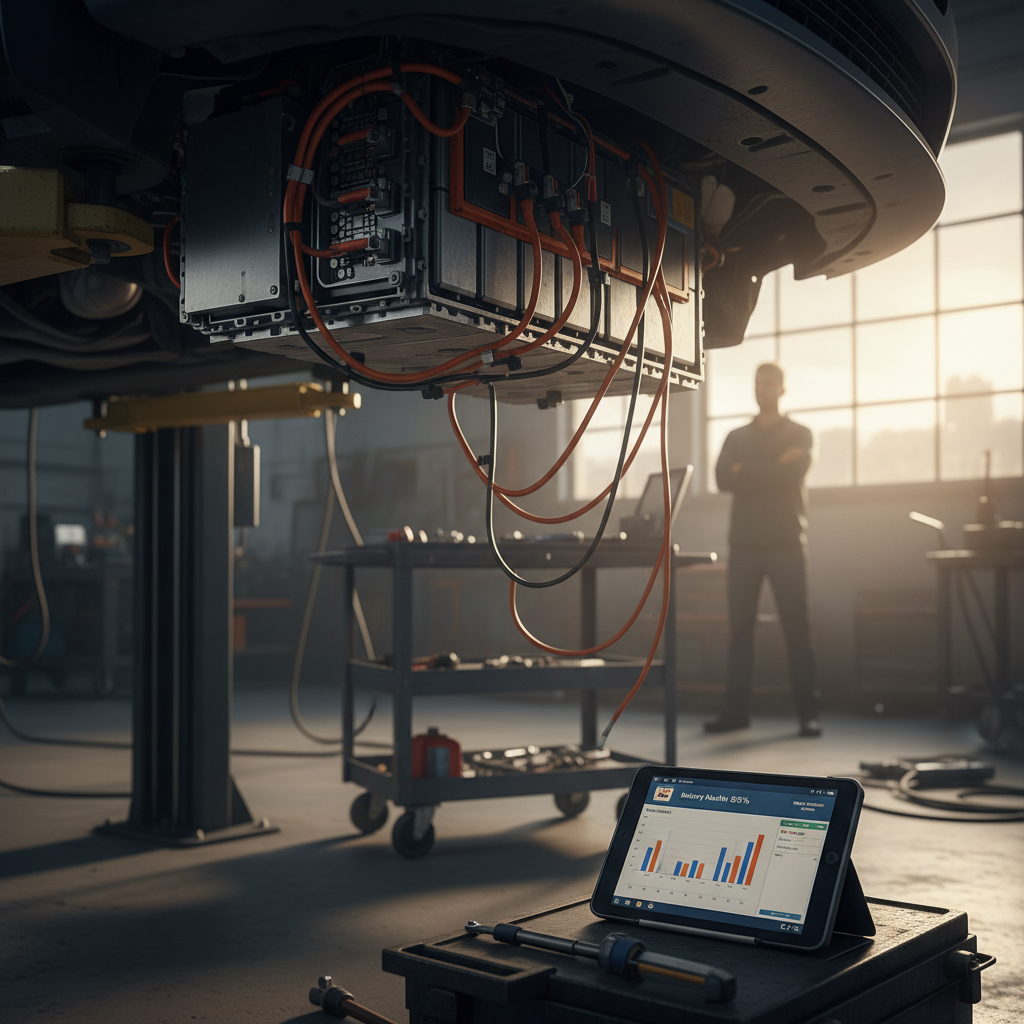

- Battery health is the big variable, this is where independent diagnostics matter.

- More choice and transparency online, especially with purpose-built used EV marketplaces like Recharged.

Where Recharged fits in

How mileage, battery and wear-and-tear affect your lease

Lease contracts are built around predicted depreciation. With EVs, mileage, cosmetic condition, and battery health all feed into that, even if you’re not charged line by line for each factor.

Key factors that move the needle on an EV car lease

1. Annual mileage allowance

Standard leases assume 10,000–12,000 miles per year. If you regularly drive 15,000+ miles, the per-mile overage (often $0.15–$0.30) can erase any savings. In that case, ask for a higher-mileage lease up front and compare that cost to buying.

2. Battery warranty vs. lease term

Most EV battery warranties run 8–10 years and 100,000 miles. A 2–4 year lease sits well inside that window, which is part of why lenders have been comfortable writing EV leases, they’re not holding the car after warranty expiration.

3. Fast charging habits

Lease contracts don’t currently price in your fast-charging usage, but heavy DC fast charging can accelerate battery wear in some models. If you end up loving the vehicle and want to buy it at lease end, that history will matter for long-term range.

4. Wear-and-tear at turn-in

Expect a turn-in inspection. Small scratches, minor curb rash and interior scuffs are usually considered normal. Deep dents, cracked glass, and bald tires are not. If you’re rough on cars, factor in a reconditioning budget, or consider buying a used EV where that wear is priced in up front.

Don’t ignore the fine print

How to shop smart for an EV car lease

In a market where federal support has stepped back and automakers are recalibrating, you have to be more deliberate about shopping for an EV car lease. Treat advertised specials as starting points, not final offers.

Six moves to get a better EV lease

You don’t have to be a finance pro, just systematic.

1. Compare effective cost

Add your total payments + money due at signing, then divide by the number of months. That’s the number you should compare across models, not just the headline monthly payment.

2. Negotiate the selling price

Even on a lease, the capitalized cost (selling price) is negotiable. Use online pricing tools and competing quotes to push it down, just like you would if you were buying.

3. Ask about hidden incentives

Lease cash, conquest bonuses, loyalty rebates and dealer-specific discounts can stack. Ask directly what’s available for your situation and ZIP code.

4. Match the term to your risk tolerance

Shorter leases (24–30 months) cost a bit more per month but keep you closer to the cutting edge of technology and reduce long-term uncertainty.

5. Be realistic about miles

If you routinely drive 15,000–18,000 miles a year, price a higher-mileage lease or compare with buying. Don’t assume you’ll just “stay under” if you never have before.

6. Test the real range

Before signing, take a thorough test drive and, if possible, borrow the car overnight. Watch how range estimates behave with your driving style and climate, that’s the experience you’re signing up for.

Use pre-qualification to your advantage

When a used EV and financing makes more sense

With subsidized EV leases less generous than they were earlier in the decade, a lot of value-conscious shoppers are discovering that a lightly used EV can undercut a new lease payment, without locking them into strict mileage caps. The key is understanding battery health and long-term running costs.

Situations where a used EV shines

- High-mileage drivers: If you log 15,000–20,000 miles per year, lease penalties can get ugly. Owning a used EV lets you drive as much as you need.

- Long-term keepers: If you keep cars 7–10 years, buying a 2–5 year-old EV and running it through the rest of its life often wins on total cost.

- Budget-focused shoppers: Steep early depreciation means you can often get a well-equipped, low-mileage EV for the price of a bare-bones new model.

How Recharged de-risks used EV ownership

Battery uncertainty is what scares many buyers away from used EVs. That’s exactly what Recharged is built to solve:

- Recharged Score battery diagnostics: We independently measure real battery health instead of guessing from age and mileage.

- Fair market pricing: Each car is priced against the broader market, with battery condition factored into the number.

- Expert EV support: Our specialists walk you through range expectations, charging options and ownership costs so you’re not buying blind.

- Digital-first buying: Browse, finance, trade-in and arrange delivery online, or visit our Experience Center in Richmond, VA.

FAQ: EV car lease questions answered

Common EV car lease questions

Bottom line: is an EV car lease right for you?

An EV car lease remains a powerful tool, just not the universally great bargain it was when federal credits were flowing freely into monthly payments. If you value low upfront cost, like to change cars every few years, and stay within average mileage, leasing a new EV can still make a lot of sense, especially when a manufacturer is leaning on lease cash to move inventory.

If you drive more than 12,000–15,000 miles a year or care most about total cost over 5–10 years, a carefully chosen used EV with strong battery health will often win on pure economics. That’s where Recharged comes in, helping you understand real battery condition, fair pricing and the financing options that fit your budget, so you can compare a used EV purchase directly against the lease offers in front of you.

Whichever path you choose, leasing a new EV or buying a used one, the key is to run the numbers, be honest about your driving, and use independent data where you can. The EV market is moving fast, but with the right information in hand, you don’t have to guess your way into your next electric car.