If you’ve been shopping for an electric car lately, you’ve probably seen splashy ads for EV lease deals that look almost too good to be true, low monthly payments, bonus cash, maybe a free home charger tossed in. In 2025, leasing has become one of the most common ways Americans get into an EV, but the rules of the game have changed this year. This guide walks you through how EV leases work now, what counts as a genuinely good deal, and how to compare offers so you don’t overpay.

Quick snapshot

Why EV lease deals are everywhere in 2025

EV leasing by the numbers

Why the rush to lease? Two big reasons. First, EVs are still pricier than comparable gas cars, so leasing lets you drive something nicer for a lower monthly payment. Second, the technology is moving quickly, battery chemistries, charging standards, software, so many drivers like the idea of handing back the car in 2–3 years and deciding later whether they want the next generation.

Who benefits most from EV lease deals?

How EV lease deals work (and where the discounts come from)

Under the marketing gloss, an EV lease is just a long rental with a very specific math problem behind it. Three numbers drive every offer you see:

- MSRP and selling price – What the car costs and how much discount the dealer or automaker is applying before incentives.

- Residual value – What the finance company thinks the EV will be worth at the end of the lease. Higher residuals usually mean lower payments.

- Money factor – The interest rate, just written in leasing language. Multiply the money factor by 2,400 for a rough APR.

When you see an advertised EV lease deal, say $259 a month for 24 months, there are usually several layers of support under the hood: factory rebates, “lease cash,” possibly loyalty or conquest bonuses, and sometimes previous federal tax credits. The key is that you’re paying for the portion of the car you use, plus interest and fees, instead of the whole thing.

Lease

- Lower monthly payment for the same EV.

- Shorter term (often 24–36 months).

- Walk away at the end, or buy it if the price makes sense.

- Mileage limits and wear-and-tear rules apply.

Loan (Buy)

- Higher monthly payment, but you’re working toward ownership.

- No mileage limits once the loan is paid off.

- Resale value risk is on you.

- Best if you’ll keep the car 6–10 years.

What’s changed in 2025: tax credits and incentives

From 2023 through late 2025, EV leases got a huge boost from a federal rule that let leased vehicles qualify as “commercial” and capture up to a $7,500 clean-vehicle credit, even when a purchase of the same car wouldn’t qualify. Many brands quietly funneled that money into lower monthly payments.

Key 2025 change

You’ll still see aggressive EV lease deals in late 2025, but they’re more likely to be driven by automaker discounting, competition, and inventory needs, not federal tax magic. In some cases, brands have nudged lease prices up after the change, while keeping sticker prices steady. That makes it even more important to compare multiple models and calculate the full cost of a lease instead of chasing the lowest headline payment.

What actually counts as a good EV lease deal?

Signs you’ve found a strong EV lease deal

Look beyond the monthly payment to the total picture.

Low effective monthly cost

Add your down payment and fees to all the monthly payments, then divide by the number of months. Strong deals often have a low effective cost relative to MSRP.

Reasonable drive-off

Big down payments make any lease look cheap. A fair deal keeps cash due at signing in check and doesn’t bury huge fees in fine print.

Competitive term & mileage

Most EV lessees do well with 24–36 months and 10,000–12,000 miles per year. If you drive more, check per‑mile overage carefully.

A useful rule of thumb: if the total of all payments (including what you pay at signing) comes out to around 1.0–1.2% of the vehicle’s MSRP per month, you’re in solid territory for a mainstream EV. Luxury models and hot new releases often sit higher; slower‑selling models can come in lower.

Quick mental math

Examples of strong EV lease deals right now

Every month brings a different batch of EV lease specials, and the best offers vary by region and credit tier. As of November 2025, some attention‑grabbing examples on new EVs include:

Representative EV lease deals – November 2025 (manufacturer promos)

These are national or regional advertised offers for well‑qualified lessees. Dealers may add their own fees or adjust pricing.

| Model | Sample advertised payment | Term & miles | Due at signing | Notable perks |

|---|---|---|---|---|

| 2025 Hyundai IONIQ 6 (SE RWD) | From ~$229/mo | 24 months, 10,000 mi/yr | ~$3,999 | 0% APR purchase option, up to $7,500 bonus cash on some trims |

| 2025 Kia Niro EV | From ~$209/mo | 24 months, 10,000 mi/yr | ~$3,999 | Up to $10,000 bonus cash stacked into leases or low‑APR loans |

| 2025 Kia EV6 (Light LR RWD) | From ~$309/mo | 24 months, 10,000 mi/yr | ~$3,999 | 0% APR for up to 72 months if you choose to buy instead |

| 2025 Ford Mustang Mach‑E Select | From low‑$200s/mo (regional) | 24 months, 10,500 mi/yr | ~$4,499 | Lease cash plus, in some regions, a complimentary Level 2 home charger install |

| 2026 Tesla Model 3 RWD | From low‑$300s/mo | 24–36 months, mileage varies | ~$3,000 | Supercharging credit for some trade‑ins; lease pricing recently rose after federal credit ended |

Always verify current terms in your ZIP code and read the full lease disclosure before signing.

Your deal will vary

How to compare EV lease offers like a pro

Checklist: Comparing EV lease deals

1. Calculate the effective monthly cost

Take the total you’ll pay (down payment + acquisition and doc fees + all monthly payments) and divide by the number of months. That’s your true monthly cost, often very different from the advertised payment.

2. Match lease term to battery confidence

On an all‑new model, a <strong>24–27 month term</strong> limits your exposure to unknown resale value. On a proven EV, stretching to 36 months can tame the payment without locking you in for too long.

3. Check residual value and buyout

Ask for the residual percentage and the precise buyout price at lease end. If the buyout is low relative to expected used values, you’re getting a better deal now, and you might have a future bargain to purchase.

4. Look at mileage realistically

If you drive 15,000+ miles per year, compare higher‑mileage leases against buying. Overages at $0.25–$0.30 per mile add up quickly on road‑trip‑friendly EVs.

5. Factor in charging costs and perks

Free home charger installation, public charging credits, or discounted nighttime electricity can shift the math. Two lease offers with identical car payments can feel very different in day‑to‑day costs.

6. Compare total cost vs buying a used EV

Before you sign a shiny new‑car lease, see what a <strong>low‑mileage used EV</strong> would cost with a loan. Thanks to rapid depreciation, you may be able to own a 2–3‑year‑old EV for a similar monthly outlay.

New vs used EV lease deals

Most of the advertising noise focuses on new EV lease deals, because that’s where automakers can pull the most levers, rebates, bonus cash, subsidized money factors. But the used EV world is where your long‑term value can really shine, whether you lease or buy.

Leasing a new EV

- Lower risk if future resale values drop.

- Access to the latest tech and range.

- Ideal when automakers are piling on lease cash or free charging perks.

- Best if you’re happy to swap vehicles every 2–3 years.

Leasing or buying a used EV

- Can be dramatically cheaper because EVs depreciate quickly in the first 3 years.

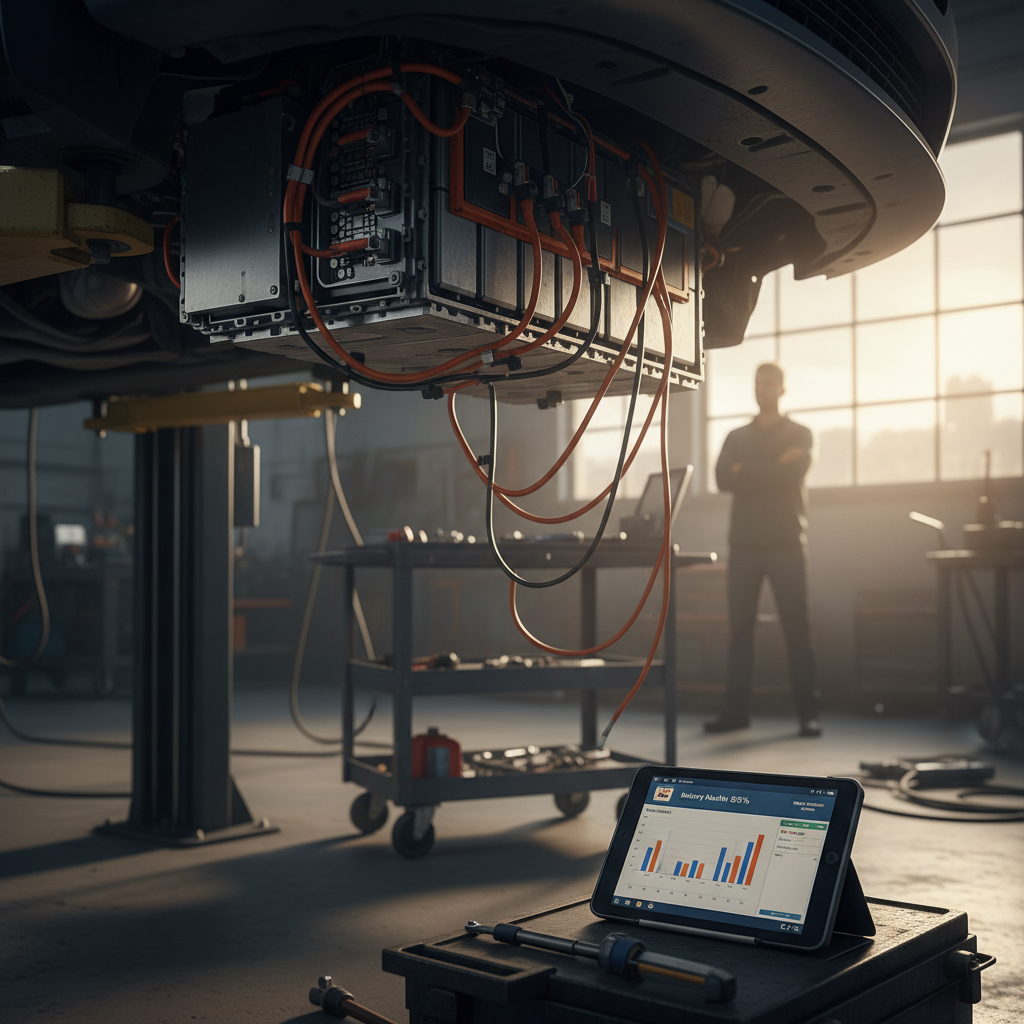

- Battery health matters more than almost anything else; look for verified diagnostics.

- Leases on used EVs are less common, but when offered, they can be very affordable.

- Buying a used EV gives you ownership and flexibility if you fall in love with it.

Where Recharged fits in

When leasing an EV makes more sense than buying

Scenarios where EV leasing shines

If these sound like you, leasing deserves a serious look.

You’re EV‑curious, not EV‑committed

You want to try living with an EV, charging, range, road trips, without betting on long‑term resale value or guessing which connector standard will win for the next decade.

You write off a company car

If you use the EV for business, a lease can simplify deductions. Work with your tax professional to see whether a leased EV pairs well with your write‑off strategy.

You value new tech and safety

Driver‑assist systems, infotainment, range and charging speeds are improving quickly. A 24–36‑month lease keeps you close to the leading edge without the hassle of selling.

On the other hand, if you keep cars for 8–10 years, log high mileage, and don’t mind driving something that’s no longer the latest thing, buying, especially buying used, often wins on pure dollars.

Common pitfalls to avoid with EV lease deals

Watch out for these traps

- Huge money due at signing – A $219 payment can hide a painful $6,000–$8,000 upfront bill. Always ask for a quote with minimal drive‑off so you can compare apples to apples.

- Low‑ball mileage limits – If a deal is based on 7,500 miles per year and you drive 13,000, overage charges can wipe out any savings.

- Questionable add‑ons – Paint coatings, nitrogen in tires, and extra “protection packages” don’t change your lease residual but can quietly inflate the capitalized cost.

- Sky‑high disposition and purchase fees – Check what you’ll pay if you walk away at the end, and if you decide to buy the EV. Those fees are negotiable more often than you’d think.

- No transparency on battery health (used EVs) – If you’re leasing or buying used, you want more than a dashboard guess at range. Look for third‑party battery diagnostics and clear documentation.

How Recharged can help on the used EV side

New EV leases are designed to be simple on the surface and complicated underneath. Used EVs flip that: there’s less marketing noise, but more homework to do on battery health, pricing, and history. That’s the puzzle Recharged was built to solve.

- Every car on Recharged comes with a Recharged Score, including verified battery health diagnostics so you know how much real‑world range to expect.

- You get transparent, fair‑market pricing and side‑by‑side comparisons, so it’s easy to weigh a low‑payment new lease against owning a 2–4‑year‑old EV outright.

- Financing, trade‑in, and nationwide delivery are built in, and EV specialists walk you through questions like home charging, warranties, and long‑term costs.

- If you’re coming out of a lease, Recharged can help you sell or trade your current EV and move into your next one with a fully digital experience, or visit our Experience Center in Richmond, VA if you prefer to talk in person.

EV lease deals FAQ

Frequently asked questions about EV lease deals

Bottom line: making today’s EV lease deals work for you

EV lease deals in 2025 aren’t the wild bargains they were when federal credits were doing half the work, but they can still be a powerful way to get into an electric car with manageable payments and limited risk. The key is slowing down long enough to understand the structure of the deal: how much you’re really paying each month, what assumptions are baked into residual values, and how the total cost stacks up against simply owning a well‑chosen used EV.

If you’re leaning toward leasing new, use the tools you have, online calculators, competing quotes, and those rule‑of‑thumb percentages, to separate the truly compelling offers from the merely shiny ads. And before you sign, take a few minutes to compare those payments to a low‑mileage used EV with verified battery health. On Recharged, you can browse used EVs, see each car’s Recharged Score, arrange financing, and trade in your current vehicle without leaving the couch. Whether you end up in a brand‑new lease or a carefully chosen used EV, the same principle holds: understand the numbers, respect the battery, and you’ll be in great shape for your next few years of electric driving.