If you’ve looked into electric vehicles lately, you’ve probably run into at least one Chinese EV company, even if you didn’t realize it. Brands like BYD, NIO, Xpeng, and Li Auto are reshaping the global EV market, changing how quickly prices fall and which features buyers now expect as standard. In this guide, you’ll see who the major players are, how big China’s EV industry has become, and what their rise means if you’re shopping for a new or used EV in the United States.

Quick take

Why Chinese EV companies matter in 2025

Chinese EV companies matter for three core reasons: scale, speed of innovation, and export power. China produced nearly 12.9 million new energy vehicles (battery‑electric and plug‑in hybrid) in 2024, giving it a dominant share of global EV output. That sheer volume lets automakers spread development costs over more vehicles, push down battery prices, and experiment with new body styles and software features faster than most Western rivals.

For US shoppers, this isn’t just a story about foreign brands you can’t yet buy here. The pressure from Chinese automakers is already influencing MSRPs, discounts, and tech features on vehicles sold by Ford, GM, Hyundai–Kia, Tesla, and others. Over time, that flows into the used market as more affordable EVs cycle through second and third owners, exactly the space where platforms like Recharged operate.

China’s EV industry by the numbers

How big is China’s EV industry? Key numbers

China is now the world’s largest EV producer and one of the most mature EV markets. In 2024, new energy vehicles reached around 41–48% of all new light‑vehicle sales, depending on which segments you include. That’s a huge jump from low‑single‑digit share just a few years earlier.

- China’s EV production has topped 12 million units annually, with battery‑electric vehicles (BEVs) still the majority but plug‑in hybrids growing fast.

- More than 1.2 million electric and plug‑in hybrid vehicles were exported in 2024, even as Europe and the US added new tariffs and investigations.

- In some Chinese cities, EV adoption is so high that charging infrastructure and grid management are now central planning issues, not pilot projects.

Tariffs are reshaping the export picture

Major Chinese EV companies you should know

When people talk about a “Chinese EV company,” they’re usually referring to one of a few high‑visibility players, but the ecosystem is much broader. Here are the brands that matter most right now, and why.

The major Chinese EV companies at a glance

From mass‑market workhorses to premium tech players

BYD

Segment: Mass‑market to premium, passenger cars and buses.

Why it matters: BYD has become the world’s largest EV maker by volume, selling millions of plug‑in vehicles and exporting more than 400,000 in 2024 alone. Its DM‑i plug‑in hybrid tech and blade battery design have pushed price and safety benchmarks for competitors.

NIO

Segment: Premium crossovers and sedans.

Why it matters: NIO is known for battery‑swap stations, premium interiors, and software‑driven features. It has expanded into Europe with swap networks in countries like Norway, Germany, and the Netherlands.

Xpeng

Segment: Tech‑centric EVs with advanced driver assistance.

Why it matters: Xpeng leans heavily on software, highway and urban driver‑assist features and heavy OTA updates. It’s positioning itself as a direct competitor to Tesla’s tech story.

Li Auto

Segment: Large family SUVs, many with range extenders.

Why it matters: Li Auto grew fast by selling three‑row SUVs with gasoline generators onboard, easing range anxiety in China’s suburbs. It sold around 500,000 vehicles in 2024, all domestically.

SAIC / MG

Segment: Mass‑market and value‑oriented EVs.

Why it matters: SAIC owns MG, a historically British brand now selling electric crossovers across Europe, Australia, and other regions. It’s proof that familiar badges may hide Chinese ownership.

Geely Group (incl. Zeekr, Volvo stake)

Segment: From entry EVs to premium, plus stakes in Volvo, Polestar, and others.

Why it matters: Geely is a sprawling group. Its Zeekr brand and partnerships give it a global footprint that blurs the line between “Chinese” and “Western” brands.

Emerging and niche Chinese EV brands

Beyond the headliners, several other Chinese EV companies are quietly building share:

- Aion (GAC) – Value‑focused EVs popular in China’s non‑tier‑one cities and expanding into Southeast Asia.

- Wuling – Known for tiny, ultra‑cheap city EVs like the Hongguang Mini EV, a hit in China and parts of Southeast Asia.

- Zeekr – Geely’s premium EV brand, designed to compete directly with Tesla, NIO, and German luxury marques.

Not all exports are branded as Chinese

Some vehicles built in China carry non‑Chinese badges. Tesla, for example, has exported large numbers of Shanghai‑built Model 3s and Model Ys to Europe and other regions. Joint‑venture brands like Volvo, Polestar, and Dacia Spring have also relied on Chinese production.

So when you see an unfamiliar badge overseas, or a familiar one on a car built in China, you’re still looking at the output of the same ecosystem.

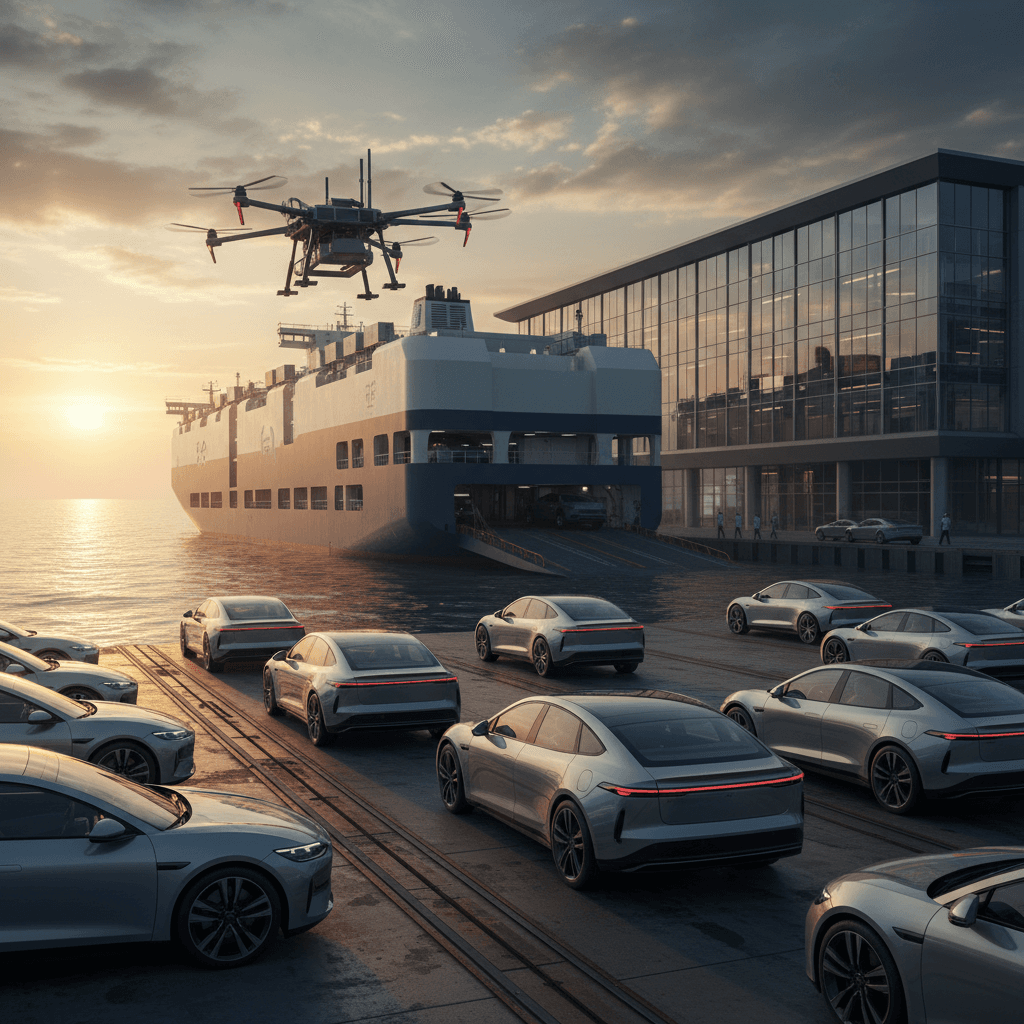

How Chinese EV companies are expanding globally

Chinese EV companies are not just exporting finished vehicles; they’re building a global industrial footprint. As tariffs and political pressure rise, more brands are turning to local assembly plants and partnerships outside China.

Global expansion strategies of major Chinese EV companies

How leading Chinese EV brands are getting their cars closer to buyers worldwide.

| Brand | Key Regions | Main Strategy | Example Move |

|---|---|---|---|

| BYD | Europe, Latin America, Southeast Asia | Direct exports + local plants | New factory projects in Europe; final assembly in Thailand and Brazil. |

| SAIC / MG | Europe, UK, Australia | Reviving existing brand, local dealers | MG electric crossovers sold through traditional dealer networks. |

| NIO | Europe | Direct sales + battery‑swap network | Battery‑swap stations along key European corridors. |

| Aion (GAC) | Southeast Asia | Local assembly for regional markets | Plant in Thailand to supply ASEAN markets. |

| Wuling | Indonesia, Southeast Asia | Micro EVs with local assembly | Assembly and battery production in Indonesia for its mini EVs. |

Localization helps Chinese EV companies blunt tariffs and shorten delivery times.

Watch the VIN plate

How Chinese EV companies affect EV prices and competition

When one region can build millions of EVs a year, it changes the math for everyone else. Chinese EV companies have helped push down battery costs per kWh through both vertical integration and brutal domestic competition. That price pressure flows through lithium‑ion cell suppliers, pack integrators, and eventually to global OEMs.

Four ways Chinese EV companies shape pricing and features

1. Lower battery costs

BYD and CATL, among others, manufacture batteries at enormous scale. That keeps global pack prices moving downward, which makes long‑range EVs more affordable over time.

2. More standard tech

Aggressive competition at home has led Chinese brands to include large screens, advanced driver‑assist features, and connected‑car services even on lower‑priced models. Western brands can’t ignore that benchmark.

3. Faster model cycles

It’s common for Chinese brands to iterate quickly, refreshing models and software in short cycles. That pushes others to update more frequently, which benefits shoppers but complicates residual‑value calculations.

4. Exported price pressure

Even with tariffs, the threat of lower‑priced Chinese EVs entering Europe and North America influences how Ford, GM, Hyundai–Kia, and others price their own EVs and plug‑in hybrids.

US protection is real, but so is indirect competition

Can you buy a Chinese EV in the US today?

Right now, you cannot walk into a US dealership and buy a BYD, NIO, Xpeng, or Li Auto‑branded vehicle. Policy, tariffs, and political risk make a direct US launch a tough bet for most Chinese EV companies in the short term.

Direct presence: limited

No major Chinese EV passenger‑car brand has a full retail operation in the United States today. The combination of 100% tariffs on Chinese‑built EVs, safety and data‑security scrutiny, and already‑crowded dealer networks is a formidable barrier.

You may, however, see Chinese‑built vehicles with non‑Chinese badges in US ports or auction lanes over time, especially if OEMs adjust sourcing strategies.

Indirect presence: growing

Chinese EV companies and suppliers are present in the US in other ways:

- Battery and materials supply agreements with global OEMs.

- Joint ventures or licensing deals around platforms and components.

- Chinese‑built vehicles sold elsewhere that may eventually show up in the US as used imports.

For used‑EV shoppers, this means your car may rely on Chinese‑sourced technology even if the badge is American, Korean, or European.

Policy is a moving target

Shopping for a used EV: what Chinese competition means for you

Even if you never buy a Chinese EV, the rise of Chinese EV companies changes the economics of used EV ownership. More global supply, lower battery costs, and faster product cycles all ripple through depreciation and feature expectations.

How China’s EV boom affects US used‑EV shoppers

You’ll see the impact even if you never buy a Chinese brand

More range per dollar over time

As battery prices fall and global competition intensifies, newer EVs tend to offer more range and features at similar or lower MSRPs. That pushes older models’ prices down faster, which is good news if you’re hunting for value on the used market.

Tech moves quickly

Chinese brands help normalize huge screens, advanced driver‑assist, and connected services even on mainstream cars. When those expectations filter into US models, yesterday’s high‑end features become tomorrow’s used‑car bargains.

Faster model turnover

Shorter product cycles in the global EV market mean more frequent refreshes and more vehicles eventually entering the used pool. That increases your options, but also makes it more important to understand the exact battery and software spec of the car you’re buying.

The importance of battery health

With rapid innovation coming from China and elsewhere, battery health reports become a key part of protecting your investment. Tools like the Recharged Score give you a measured view of pack condition, expected range, and fair market valuation.

How Recharged can help

Future outlook: what’s next for Chinese EV companies

Looking ahead to the late 2020s, Chinese EV companies are unlikely to fade. If anything, they’ll become more intertwined with the global auto industry, through joint ventures, shared platforms, battery‑supply deals, and factories outside China.

Two likely paths for Chinese EV companies and the US market

Scenario 1: Indirect integration

Chinese companies deepen their roles as battery and platform suppliers to global OEMs.

More vehicles sold in the US quietly ride on Chinese‑developed platforms or use Chinese‑sourced packs.

US shoppers see lower prices and better specs, but not many Chinese badges on grilles.

Scenario 2: Gradual direct entry

Policy or trade dynamics soften over time, especially if US‑based production is involved.

One or two Chinese brands experiment with limited US launches in specific states or segments.

Competition heats up, accelerating price declines for new EVs and making used EVs more affordable sooner.

What you can do now

FAQ: Chinese EV companies and the US market

Frequently asked questions about Chinese EV companies

Chinese EV companies have already changed the global auto industry, even if you don’t see their showrooms on Main Street. Their scale, speed, and export power are pushing prices down, accelerating tech upgrades, and reshaping how quickly EVs move through the new and used markets. If you’re shopping for an EV in the US, the smart move is to leverage that competition: target vehicles that offer strong range and features for the money, and always verify battery health and fair pricing. That’s where Recharged, and tools like the Recharged Score Report, help you turn a complex global story into a clear, confident purchase decision.