If you’ve heard that EV resale value is a problem, you’re not imagining it. In 2025, most electric vehicles still depreciate faster than comparable gas cars, but that’s only half the story. The other half is that a savvy buyer or seller can use those trends to their advantage and dramatically change the total cost of ownership.

Quick snapshot

What EV resale value really looks like in 2025

EV resale value by the numbers

Two big trends define EV resale value in late 2025: 1. Depreciation is steeper on average. Several independent studies have found that many EVs lose value almost 30% faster than the overall vehicle market over five years. That’s driven by rapid tech changes, shifting incentives, and a surge of off‑lease EVs entering the used market. 2. Total ownership cost can still favor EVs. Even with tougher depreciation, lower fueling and maintenance costs mean a well‑chosen EV can still cost less to own over five years than a comparable gas model, especially if you buy used instead of new.

Resale value vs. total cost of ownership

Why EVs often depreciate faster than gas cars

Four main reasons EVs lose value faster

Most of the resale story comes down to tech, incentives, and supply–demand swings.

1. Rapid tech turnover

2. One‑time tax credits

3. Off‑lease wave

4. Brand and sentiment swings

Don’t overgeneralize

The 7 biggest factors that shape EV resale value

- Battery health and remaining range

- Brand reputation and demand in the used market

- Real‑world driving range versus newer competitors

- Charging speed and plug standard (CCS vs. NACS)

- Warranty coverage that transfers to the next owner

- Incentives and rebates available when the car was new

- Overall condition, mileage, accident history, and service records

Range and charging matter more than ever

Range anxiety hasn’t disappeared, so buyers pay close attention to EPA range and DC fast‑charge capability. An older 150‑mile EV with slow charging will depreciate more sharply than a similar‑age model that can comfortably do 240–280 miles and charge from 10–80% in under 40 minutes.

Brand reputation is amplified in EVs

Because EV shoppers worry about long‑term battery durability and software support, trust in the brand plays an outsized role. Well‑known makers with strong EV track records generally enjoy better resale than niche or short‑lived entries, all else equal.

Where Recharged fits in

Which EVs hold their value best right now?

Resale performance is changing quickly as prices, incentives, and competition shift, but a few broad patterns have emerged by late 2025:

Illustrative EV resale performance by segment

Approximate five‑year value retention ranges for popular EV types, based on recent market analyses and used‑market pricing patterns.

| Segment / Example | Typical 5‑yr Value Retained | What’s Helping | What’s Hurting |

|---|---|---|---|

| Compact hatchback (e.g., Nissan Leaf, Chevy Bolt EV) | 35–45% | Low used prices and simple packaging attract budget shoppers. | Shorter range on early models; buyers worry about out‑of‑warranty batteries. |

| Mainstream crossover (e.g., Hyundai Kona Electric, Kia Niro EV, VW ID.4) | 40–55% | In‑demand body style; solid ranges around 220–260 miles; improving brand familiarity. | Competition from newer 300‑mile crossovers; rapid new‑car discounts. |

| Popular premium models (e.g., Tesla Model 3/Y, Hyundai Ioniq 5, Kia EV6) | 45–60% | Strong demand, good fast‑charging, frequent software updates keep them feeling modern. | Price cuts on new vehicles can drag used values down in the short term. |

| Luxury flagships (e.g., Taycan, EQS, Model S, Lucid Air) | 35–50% | Well‑heeled buyers like the tech and performance; some have lower running costs than ICE peers. | Luxury cars of all types depreciate heavily, and EV incentives magnify the effect from MSRP. |

These are ballpark bands, not exact forecasts for any single VIN. Always check live data when you’re buying or selling.

Why some “bad” resale can be good for you

How battery health really impacts EV resale value

Battery health is the single most misunderstood piece of the EV resale puzzle. Most modern EV packs are aging better than early skeptics predicted, but how that health is documented has a huge effect on used values.

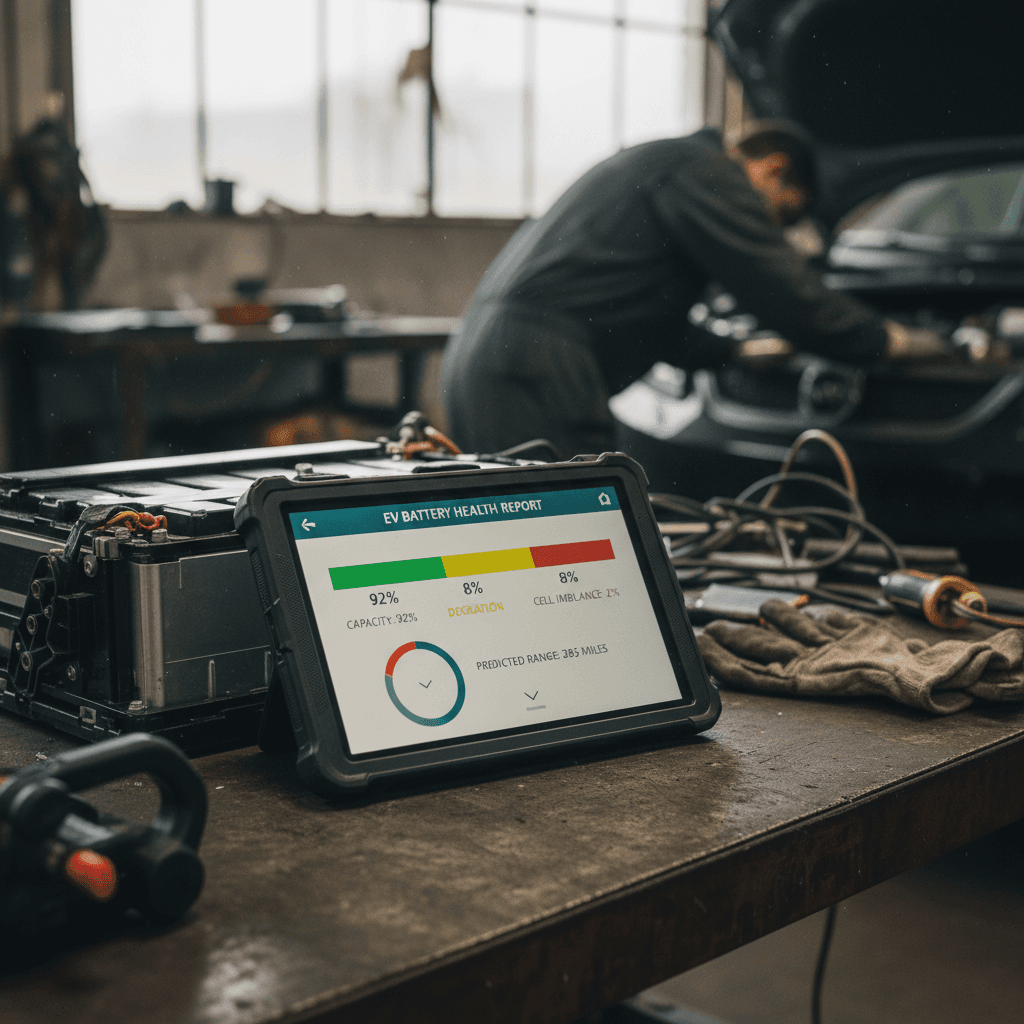

What buyers and lenders look for in battery health

Three questions that can move an appraisal thousands of dollars in either direction.

1. State of health (SoH)

2. Documentation

3. Warranty coverage

How Recharged uses battery data

How to protect your EV’s resale value as an owner

Six habits that help your EV hold value

1. Be kind to your battery

Avoid living at 100% or 0% state of charge. For daily use, keeping your EV between about 20% and 80% reduces long‑term degradation compared with constant max‑charging.

2. Limit unnecessary DC fast charging

Road trips are fine, but relying on DC fast charging every day can stress the pack. Frequent fast‑charge history can translate into tougher questions at trade‑in time.

3. Keep software up to date

Over‑the‑air updates can improve range, charging curves, and features, all of which support stronger resale. Skipping updates can make the car feel older than it really is.

4. Stay current on maintenance and recalls

Even though EVs need less routine service, tire rotations, brake inspections, and recall campaigns matter. A tidy digital service history is worth real money on appraisal day.

5. Protect the interior and screens

EVs lean heavily on large touchscreens and modern cabins. Avoid screen damage, fix small cosmetic issues early, and document any upgrades like all‑weather mats.

6. Time your sale around incentives

If new versions of your EV qualify for large, stackable incentives, used prices can soften. Selling before a big incentive change, or waiting until the market stabilizes, can change your resale by thousands.

Be careful with modifications

Smart strategies when you’re buying a used EV

Used EV shoppers are in a uniquely strong position in 2025. Depreciation has already done the heavy lifting; your job is to choose the right car and verify its health so you aren’t inheriting someone else’s problems.

Step‑by‑step: how to buy a used EV with resale in mind

1. Decide how long you’ll keep it

If you plan to drive the car for five to seven years, short‑term resale swings matter less. Focus on reliability, comfort, and range. If you’ll swap in two to three years, concentrate on brands and models with steady demand.

2. Prioritize range and charging over gadgets

Heated seats and a panoramic roof are nice, but other buyers will care much more about range and DC fast‑charging speed. Those specs age better and support higher resale.

3. Ask for a real battery health report

Don’t settle for "it seems fine." Request a battery health scan or a third‑party report like the Recharged Score that quantifies usable capacity and charging behavior.

4. Compare pricing to market data

Look at multiple sources for trade‑in and retail values, adjusted for local incentives and taxes. Recharged’s fair‑market pricing tools can show where a specific VIN sits versus similar EVs nationwide.

5. Verify warranty transfer and coverage

Some EV components have longer warranties than the basic bumper‑to‑bumper coverage, and most of that protection follows the car. Knowing what’s still covered can justify paying a little more for the right example.

6. Consider financing and future flexibility

If you’re unsure how EV tech or your driving habits may change, choose loan terms that make it easy to exit in two to four years. Recharged can help you compare financing options and estimate future trade‑in ranges.

Lease, buy, or sell now? How to think about timing

When leasing makes sense

Leasing shifts resale risk to the lender. That can make sense if you:

- Want the latest tech every 3–4 years

- Are concerned about fast‑changing incentives and pricing

- Prefer a predictable path out of the vehicle at lease‑end

Many EV leases bake in relatively conservative residual values, which can protect you if the market softens.

When buying is smarter

If you drive a lot of miles, keep vehicles a long time, or want to lock in ownership costs, buying can still come out ahead, especially when you buy used after the big, early‑life depreciation hit.

Tools like the Recharged Score Report help you understand not just today’s price, but how battery health and mileage may affect value down the road.

Watch out for market whiplash

Frequently asked questions about EV resale value

EV resale value: your top questions, answered

The bottom line on EV resale value

EVs absolutely can have softer resale value than gas cars, especially in the first five years, but that doesn’t automatically make them a bad financial move. As an owner, smart charging habits, good records, and thoughtful timing can protect a lot of your investment. As a buyer, steep depreciation can be your opportunity to get a far newer, more capable vehicle than you could ever afford new.

If you’d like help running the numbers on your current EV or lining up your next one, Recharged can provide a Recharged Score Report, fair‑market pricing, and financing options tailored to used electric vehicles. That way, you’re not just hoping your EV’s resale value works out, you’re planning for it.