When people talk about electric vehicle suppliers, they usually mean automakers. In reality, every EV depends on a deep stack of suppliers, from battery giants like CATL and BYD to chipmakers, charging-network operators, and software firms that monitor battery health. Understanding who supplies what isn’t trivia; it directly affects reliability, resale value, and how confident you feel buying a new or used EV.

Quick takeaway

Why electric vehicle suppliers matter to everyday drivers

The EV market has matured fast. Global EV battery installations grew more than 30% year-over-year into 2025, and a handful of companies now dominate everything from battery cells to charging hardware. At the same time, the used EV market in the U.S. has exploded, with quarterly used EV sales crossing 100,000 units as prices fell over 30% in 2024. That means many buyers are meeting these suppliers for the first time, indirectly, when they shop for a second-hand Tesla, Hyundai Ioniq 5, or Chevy Bolt.

- Battery suppliers influence range, fast‑charging speeds, and how an EV ages.

- Charging suppliers determine where you can plug in and how reliable that experience is.

- Software suppliers control over‑the‑air updates, driver-assistance features, and even how the battery is managed.

- Retail and data players (like Recharged) turn all of this complexity into something transparent, or leave you guessing.

Why this matters more for EVs than gas cars

The EV supply chain at a glance

The 2025 electric vehicle supplier landscape in numbers

Upstream & components

- Mines & refiners for lithium, nickel, cobalt, manganese, and graphite.

- Cell manufacturers like CATL, BYD, LG Energy Solution, Panasonic, and SK On.

- Electronics and semiconductors that control inverters, battery management, and driver-assistance systems.

Downstream & customer-facing

- Automakers (OEMs) that design the vehicle and integrate the pack, motors, and software.

- Charging hardware & networks like Tesla Supercharger, Electrify America, ChargePoint, and regional fast‑charging alliances.

- Retail, financing, and data platforms like Recharged that package all this into an ownership experience.

Major EV automakers and their key suppliers

Every major automaker is effectively a system integrator in the EV era. They design the vehicle, but crucial subsystems, especially batteries and electronics, come from specialized suppliers. Some brands are vertically integrated; others lean heavily on external partners.

How leading EV automakers work with suppliers

Different supply strategies, similar end goal: secure batteries, software, and charging access.

Tesla

Tesla designs its own vehicles, inverters, and a lot of software, but it still relies on multiple battery suppliers such as Panasonic, CATL, and LG Energy Solution, alongside its own in‑house cell production.

Its vertically integrated Supercharger network is now opening to other brands via the NACS standard.

Hyundai–Kia

Hyundai, Kia, and Genesis use an in‑house E‑GMP platform, but battery supply is shared across LG Energy Solution, SK On, and CATL depending on model and region.

Their strategy mixes domestic Korean suppliers with Chinese capacity to manage cost and risk.

GM, Ford, and legacy OEMs

Detroit automakers co‑develop batteries with partners like LG Energy Solution, SK On, and Samsung SDI, investing billions in North American plants to meet policy requirements and reduce China exposure.

These choices affect pack chemistry, fast‑charging speeds, and long‑term support.

Model‑level research beats brand stereotypes

Top EV battery suppliers in 2025

EV batteries are the heart of the supply chain. As of 2025, global battery usage is dominated by a handful of companies, most of them Chinese. CATL and BYD alone account for well over half of global EV battery installations, with LG Energy Solution solidly in third place and a long tail of smaller but fast‑growing players like CALB, Gotion High‑tech, EVE Energy, SVOLT, SK On, Samsung SDI, and Panasonic.

Leading EV battery suppliers and their roles

Major cell suppliers powering today’s electric vehicles and what they’re known for.

| Battery supplier | Approx. 2025 global share | Key customers & regions | Notable strengths |

|---|---|---|---|

| CATL | ≈37% | Tesla, BMW, Mercedes‑Benz, VW Group, Chinese brands | Scale, high‑energy packs, rapid innovation (e.g., fast‑charging chemistries). |

| BYD / FinDreams | ≈18% | BYD vehicles plus growing external customers | LFP packs with strong value, vertical integration from cell to car. |

| LG Energy Solution | ≈10% | GM, Hyundai–Kia, Tesla (some models), VW, others | Deep experience in ternary chemistries, big footprint in North America. |

| CALB, Gotion, EVE, SVOLT | Low‑single‑digit each | Primarily Chinese and some global OEMs | Rapid growth, competitive LFP chemistries and pack designs. |

| SK On, Samsung SDI, Panasonic | Low‑ to mid‑single‑digit | Hyundai–Kia, Ford, BMW, Tesla (Panasonic), others | Strong in prismatic/cylindrical packs, high‑performance and premium segments. |

Market shares are indicative for 2025 and change as automakers shift sourcing and policies evolve.

Don’t ignore chemistry

Charging suppliers and network operators

Charging is where most drivers directly feel the impact of suppliers. The U.S. now has well over 200,000 public charging ports, but they’re spread across dozens of hardware vendors and network operators with very different reliability records.

Types of charging suppliers

From the plug on your wall to 400 kW highway fast chargers, multiple players are involved.

Home charging hardware

Wallboxes and portable Level 2 chargers from companies like ChargePoint, Wallbox, Emporia, Grizzl‑E, Tesla, and many smaller brands.

For most drivers, this is where 70–90% of energy actually comes from.

Public charging networks

Fast‑charging networks such as Tesla Supercharger, Electrify America, EVgo, ChargePoint, Ionna, and regional players. In Europe, alliances like Spark combine multiple operators under one virtual network.

Back‑end software & payment

Behind the pedestal are software suppliers that manage payments, uptime, and roaming so your car and app can talk to the charger.

These often aren’t visible to you, but they decide whether plugging in is painless, or frustrating.

A practical way to judge charging suppliers

Software, data, and battery-health suppliers

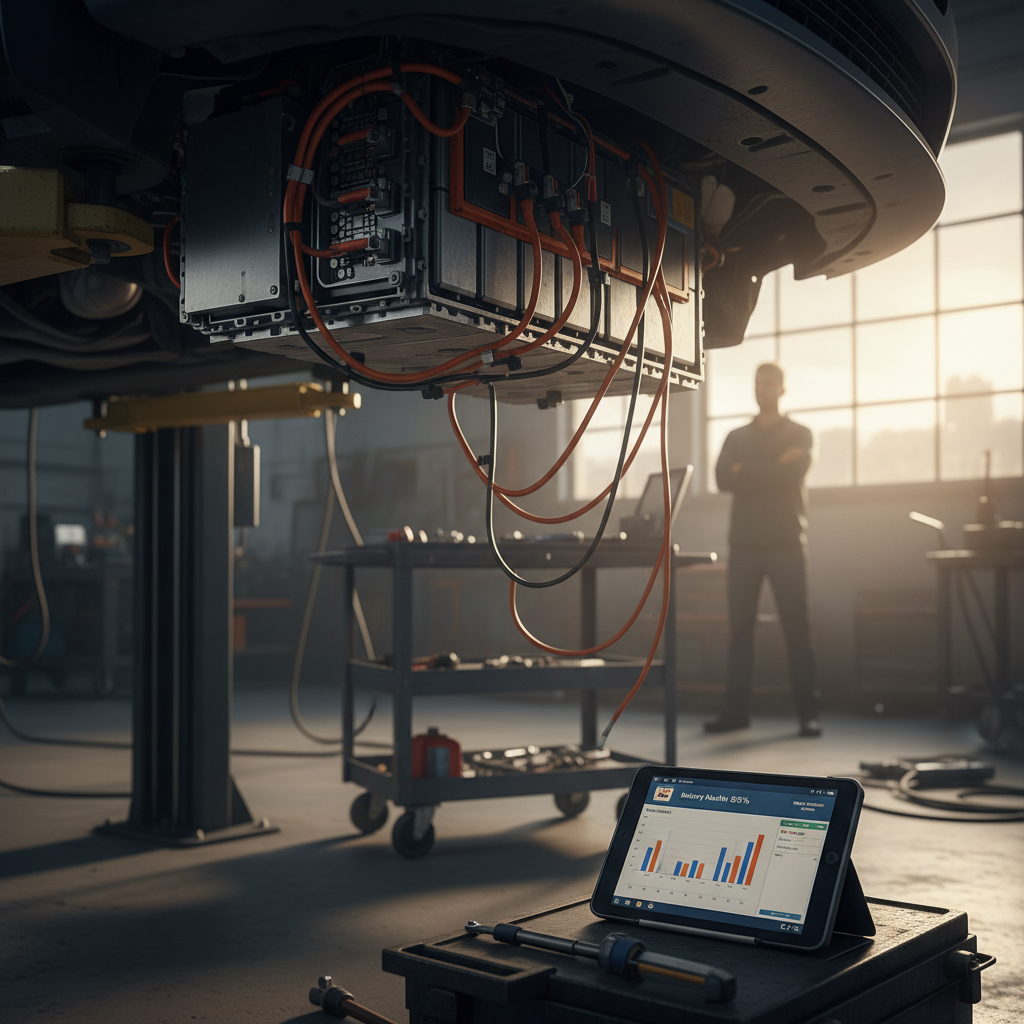

Under the skin of every EV is a digital layer. Automakers write a lot of their own code, but they also lean on suppliers for everything from driver‑assistance chips to over‑the‑air update platforms and battery analytics. Increasingly, independent companies are building tools that read pack data and estimate state of health for fleets, lenders, and used‑vehicle marketplaces.

- Chipmakers supplying processors for infotainment, driver assistance, and power electronics.

- Cloud providers hosting over‑the‑air software infrastructure and telematics data.

- Specialized analytics firms building battery‑health models and degradation forecasts.

- Retail platforms like Recharged that turn raw battery and usage data into a consumer‑friendly score.

“In a combustion car, mileage roughly tells you how ‘used’ it is. In an EV, a good state‑of‑health estimate for the battery plays that role, and the data often lives with software suppliers, not just the automaker.”

What this supplier landscape means when you buy a used EV

If you’re buying new, you mostly trust the automaker to manage its suppliers. When you’re buying used, you inherit all of those supplier choices, after years of real‑world use. That’s why the surge in the used EV market in 2024–2025 has been accompanied by a wave of questions about batteries, charging, and long‑term support.

Risks if you ignore suppliers

- Uncertain battery health if you don’t know the cell supplier, chemistry, or how the pack has been used.

- Headaches if your EV relies on a shrinking or unreliable fast‑charging network on your main routes.

- Limited software support if the automaker or key tech suppliers are exiting certain features or regions.

Upside if you pay attention

- Stronger resale value when you choose models with robust battery suppliers and transparent health data.

- Lower total cost of ownership thanks to better efficiency and less degradation.

- Higher confidence on road trips when you choose vehicles that work well with dense, reliable charging suppliers.

Why this is good news for used‑EV buyers

How Recharged uses supplier data to de-risk used EVs

Recharged was built around the idea that EVs need more transparency than gas cars. Every vehicle on the platform comes with a Recharged Score Report that blends battery‑health diagnostics, fair‑market pricing, and configuration details, so you don’t have to be an expert in every cell chemistry or charging standard.

Where supplier data shows up in a Recharged Score

Behind the scenes, supplier information turns into concrete buying signals.

Battery health & supplier mix

Knowing the underlying cell supplier and pack design helps our diagnostics interpret how “normal” a given level of degradation is for that model and mileage.

A 90% state of health can mean very different things depending on the chemistry and supplier track record.

Fair market pricing

Models with more durable battery suppliers, better charging support, or stronger software roadmaps often deserve a pricing premium, or a discount if the opposite is true.

Our valuations take these supplier realities into account, not just mileage and model year.

Financing & exit strategy

Because lenders and future buyers care about battery suppliers and charging access, we surface these details up front, so you can plan both your financing and eventual resale.

You’re not flying blind on what the market will think of your car in five years.

Beyond listings: expert-guided support

Checklist: questions to ask about EV suppliers before you buy

Key supplier questions for your next EV

1. Who supplied the battery pack?

Ask which company made the cells and what chemistry they use (LFP vs nickel‑rich). If the seller can’t answer, look for documentation or a Recharged Score that decodes it for you.

2. What’s the current battery state of health?

Don’t accept “it charges fine” as an answer. Request a quantified battery‑health report or diagnostics, ideally with model‑specific benchmarks.

3. Which fast‑charging networks does this EV work best with?

Check whether the car has native plugs (NACS, CCS) for the main networks in your area and whether adapters are needed. Look for evidence of good reliability with those suppliers.

4. How strong is software and OTA support?

Look for a history of over‑the‑air updates, safety recalls handled promptly, and clear communication from the automaker about long‑term support.

5. Are there known supplier‑related issues for this model?

Search for recalls, service bulletins, or common complaints tied to specific battery or electronics suppliers. A few minutes of research can save you a lot of hassle.

6. How will suppliers affect resale value?

Ask how widely used the same battery supplier, chemistry, and charging interface are across the market. The more standardized they are, the easier your future resale tends to be.

FAQ: electric vehicle suppliers and the EV supply chain

Frequently asked questions about electric vehicle suppliers

Conclusion: EV suppliers and your next car

The electric vehicle world isn’t just a battle of brands; it’s a web of electric vehicle suppliers competing and collaborating across batteries, charging, software, and data. For drivers, the upside is rapid innovation and falling total cost of ownership, especially in the used market. The downside is complexity: the car on your driveway reflects decisions made by cell manufacturers in China, chip designers in Europe and the U.S., and charging operators on your local interstate.

You don’t need to memorize the entire supplier landscape to make a smart choice. Focus on a few essentials: who made the battery, how healthy it is today, which charging networks you’ll rely on, and how well‑supported the software platform looks over the next decade. If you’d rather not untangle all of that alone, platforms like Recharged exist to surface the right supplier information, wrap it into a clear Score Report, and pair it with financing, trade‑in options, and expert guidance, so your next EV decision is driven by data, not guesswork.