Searches for new car manufacturers have exploded over the last few years, and for good reason. Electrification cracked the door open for fresh brands to take on century-old automakers, and suddenly names like BYD, Nio, Rivian, Lucid, Zeekr, VinFast and dozens more are competing for your attention and your money.

The short version

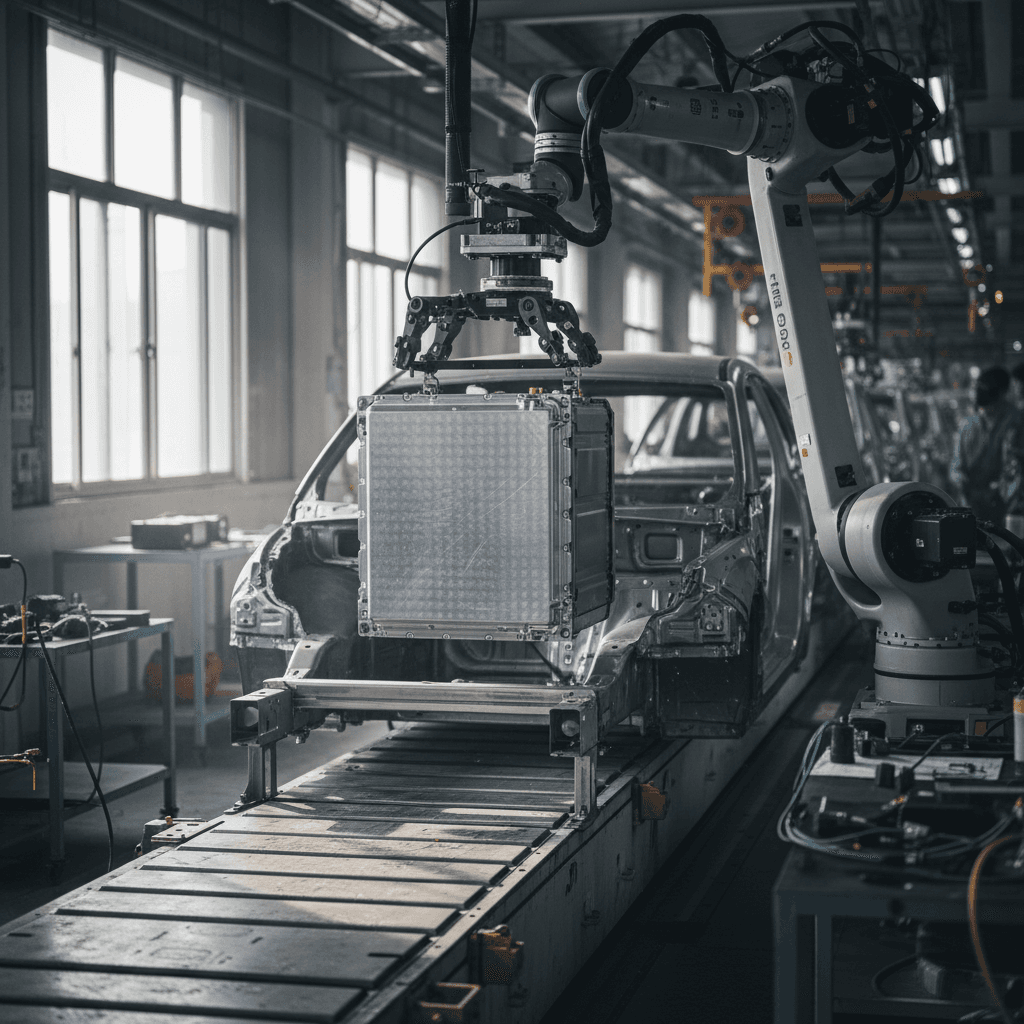

Why New Car Manufacturers Matter in 2025

In 2025, new car manufacturers are no longer a curiosity at auto shows, they’re meaningful players. Chinese brands alone now build well over half of the world’s electric cars and the majority of their batteries, and startups have pushed legacy carmakers to move faster on EVs, software, and direct-to-consumer sales models. At the same time, the wave of new EV startups that launched in the late 2010s and early 2020s is now hitting reality: high capital needs, slower-than-hyped demand, and brutal price competition.

New Car Manufacturers by the Numbers

For you as a buyer, all of this creates both opportunity and risk. You can get technology, efficiency, and design that legacy brands struggle to match, sometimes at astonishing prices. But you also face questions about long-term support, resale value, and whether a flashy new logo will still be around when your battery warranty is halfway over.

The Three Main Types of New Car Manufacturers

Not every "new" car manufacturer is the same. When you’re shopping, it helps to sort them into three broad buckets, each with different risk profiles.

Three Flavors of New Car Manufacturers

From hyper-scaled Chinese brands to fragile Silicon Valley-style startups

1. Scaled Chinese EV Giants

Brands such as BYD, Geely/Zeekr, Nio, Xpeng, Chery and Leapmotor are relatively young but already build vehicles at industrial scale.

- Heavy state and corporate backing

- Massive domestic volume, aggressive exports

- Often vertically integrated in batteries and software

2. Western EV Specialists

These are younger U.S. and European brands that build only (or mostly) EVs, think Rivian, Lucid, Polestar, VinFast, and others.

- Premium positioning or niche segments

- Lower volume, higher per-car cost

- Heavily dependent on capital markets

3. High-Risk Startups & Niche Players

Companies like Canoo or newer niche brands often have innovative ideas but limited funding or production.

- Pre-revenue or low volume

- Uncertain survival and support

- Potentially big upside, but higher buyer risk

Don’t confuse "new" with "small"

New EV Brands From China Going Global

If you’re in the United States, you may only see a handful of Chinese-brand EVs on local roads today. Globally, though, China’s new car manufacturers are the story of the EV transition. These companies have been willing to move faster on battery tech, aggressive pricing, and software-heavy cars than most Western rivals.

BYD: From battery supplier to EV superpower

BYD started as a battery company and now sells a full lineup of plug-in hybrids and battery EVs, from inexpensive city cars like the Seagull to premium models. Its in-house batteries and electronics help it keep prices low while adding advanced driver-assistance features even on entry-level models.

For buyers outside China, you’ll see BYD expanding into Europe and Latin America first, with more models trickling into North America depending on tariffs and trade policy.

Geely, Zeekr, Leapmotor & the tech ecosystem

Geely has quietly assembled a portfolio that includes Volvo, Polestar, Lotus, Smart, and the premium EV brand Zeekr. These brands share platforms, software, and supply chains, giving them scale advantages.

Leapmotor, another Chinese EV maker, has partnered with Stellantis (the group behind Jeep, Ram, Peugeot, Opel and more) to export low-cost EVs under multiple badges. That means you might eventually buy a "European" or "American" branded car that is, under the skin, a Leapmotor.

Other new Chinese car manufacturers you’ll see more of over the next few years include Nio (battery swapping, premium SUVs and sedans), Xpeng (tech-forward midsize EVs), and various joint ventures like IM Motors and Jidu that are backed by big tech firms and state-owned automakers.

How this affects used EV shoppers

New US and European EV Manufacturers

On this side of the Atlantic, the most visible new car manufacturers are EV-focused startups. Some have become real contenders; others are still fighting for survival.

Key Western New Car Manufacturers to Know

From adventure trucks to ultra-efficient luxury sedans

Rivian

Rivian builds adventure-focused EVs like the R1T pickup and R1S SUV and has attracted major investments, including a significant partnership with Volkswagen. That backing, plus decent production scale, makes Rivian one of the more durable U.S. startups.

For used buyers, Rivian’s growing fleet and improving service network are promising signs, though long-term profitability is still a work in progress.

Lucid

Lucid targets the premium end of the market with the Air sedan and the Gravity SUV, focusing on efficiency, range, and performance. It’s backed by the Saudi Public Investment Fund and has finally begun delivering its Gravity SUV.

Lucid’s tech is impressive, but volume is modest and pricing is high. On the used market, that combination can create interesting bargains, if the company maintains support and residual values stabilize.

VinFast & other global entrants

Vietnam’s VinFast, along with smaller players like Fisker’s former operations, tried to enter the U.S. quickly. Execution has been uneven: aggressive timelines, changing strategies, and quality teething issues.

Whenever a new brand races into a tough market, treat early products as beta versions and price the risk accordingly if you see them used.

Fresh names like Slate Auto

New brands continue to appear, such as U.S.-based Slate Auto, which emerged from stealth promising a sub-$30,000 transforming electric pickup. These companies may tap high-profile investors and bold ideas.

But until they’ve built and supported vehicles in volume, consider them speculative from a buyer’s perspective.

Watch the difference between hype and hardware

When New Car Manufacturers Struggle, or Fail

For every breakout success, there’s a list of new car manufacturers that have stumbled badly. In the U.S. alone, electric truck maker Nikola filed for bankruptcy protection in early 2025, and earlier names like Lordstown Motors and Proterra also landed in court. Fisker and Canoo saw demand and funding dry up, with operations winding down or being radically restructured.

That doesn’t mean every young brand is doomed. It does mean you should assume that some will disappear, or at least retreat from certain markets, over the lifespan of any car you buy. A 10-year powertrain warranty isn’t worth much if the company behind it no longer exists in year six.

- Startup-style car manufacturers often rely on continuous fundraising to keep plants running and service networks growing.

- Aggressive pricing wars, especially as Chinese brands scale, squeeze margins and make it hard for high-cost startups to reach profitability.

- Regulatory changes, tariffs, and shifting consumer incentives can quickly undermine fragile business models.

Bankruptcy doesn’t always kill a brand, but it complicates your life

Pros and Cons of Buying From a New Car Manufacturer

So should you avoid new brands entirely? Not necessarily. Many of the cars reshaping what we expect from EVs come from companies that didn’t exist 15 years ago. The key is understanding the tradeoffs.

New vs. Legacy Car Manufacturers: Key Tradeoffs

How new EV brands compare with established automakers from a buyer’s perspective

| Aspect | New Car Manufacturers | Legacy Automakers |

|---|---|---|

| Technology & UX | Often lead on battery efficiency, software, and over-the-air features. | Adopt tech more slowly; more conservative interfaces and update cycles. |

| Pricing | Can be aggressive, especially from Chinese brands or when discounting to drive volume. | Higher sticker prices but sometimes stronger incentives or dealer discounts. |

| Brand Stability | Younger, less proven; higher risk of restructuring or exit from certain markets. | Decades of history; unlikely to disappear, though EV strategies still evolving. |

| Service Network | Growing but spotty; may rely on mobile service or a few hubs. | Dense dealer networks; easier access to same-day repairs in most regions. |

| Resale Value | Can be volatile, big swings based on brand news, incentives, or competition. | More predictable, though many EVs still depreciate faster than comparable ICE cars. |

Advantages and disadvantages of buying from new car manufacturers.

When Buying From a New Brand Can Make Sense

You prioritize cutting-edge tech

If features like efficient powertrains, advanced driver-assistance, and rich in-car software matter more than badge prestige, newer manufacturers often deliver first.

You’re comfortable with calculated risk

You understand that brand stability, resale value, and long-term support are less certain, and you price that into your decision.

You find strong real-world reviews

Owner forums, long-term tests, and fleet usage data all look solid, not just marketing videos and influencer first drives.

You have local or regional service coverage

There’s a service center or mobile service coverage within a manageable distance, and you’ve checked parts and repair turnaround times.

How to Evaluate a New Car Brand Before You Buy

Think of buying from a new car manufacturer as part car purchase, part company analysis. You don’t need an MBA, but you should spend a little time looking at the fundamentals behind the badge.

New Brand Evaluation Checklist

1. Who’s backing them?

Look for major industrial partners (like a large automaker), sovereign wealth funds, or profitable parent companies. Deep-pocketed backers don’t guarantee success, but they make sudden collapse less likely.

2. How many vehicles have they actually delivered?

Announcements aren’t deliveries. Prioritize brands with tens of thousands of vehicles on the road and a track record of fixing early issues rather than those still in prototype stages.

3. What does the service footprint look like?

Map out nearby service centers, mobile service coverage, and typical appointment wait times. A great car is only as good as the support behind it.

4. How transparent are they about software and updates?

New brands lean heavily on software. Read their release notes, update cadence, and owner reports to gauge whether they treat software as a product or an afterthought.

5. What’s happening to used values?

Check used listings and auction data. If similar models are selling at massive discounts, ask why, and whether you’re comfortable with that depreciation curve.

6. Are they pivoting every six months?

Frequent strategic U-turns, shifting markets, canceling models, changing distribution overnight, are red flags that leadership is still searching for a viable plan.

Use multiple information sources

Buying a Used EV From a New Car Manufacturer

The used market is where new manufacturers become especially interesting. Rapid technology cycles and aggressive discounting on new EVs can make nearly-new cars from these brands look like bargains. But the complexity of EV batteries and software also makes due diligence more important than ever.

Upside: Value and spec for the money

Because demand has been choppy and incentives uneven, many late-model EVs from younger brands sell used at steep discounts versus their original MSRP. If you care more about real-world range and features than logo recognition, that can be a win.

You might get a long-range battery, advanced driver-assistance, and a modern interior for the price of a basic, older EV from a legacy brand.

Downside: Unknowns around support and degradation

Battery health, software support, and service stability matter more than ever when you’re buying used. A cheap EV with a tired pack or a brand that’s retreating from your region can be more hassle than it’s worth.

This is exactly where independent battery diagnostics and transparent history reporting become critical.

Where Recharged fits in

What’s Next for New EV Manufacturers

The next five years will be a consolidation phase. China is producing more EVs than its domestic market can absorb, and its automakers are racing into Europe, Latin America, and other regions. Western brands are responding with their own low-cost EV platforms, often in partnership with those very Chinese companies.

Two Likely Futures for New Car Manufacturers

1. Consolidation & partnerships

More joint ventures where Western companies rebadge or co-develop EVs with Chinese startups and tech-backed brands.

Some current nameplates disappear, but their platforms live on under different badges.

Service and parts for orphaned brands may be handled by larger partners instead of the original manufacturer.

2. Diverging strategies by region

High-tariff markets like the U.S. may favor domestic or locally built EVs, even if they leverage foreign platforms.

Emerging markets may see a flood of low-cost EVs from Chinese and regional newcomers.

Premium niches stay crowded, but only a few new luxury EV brands achieve lasting global scale.

What this means for your next EV

FAQ: New Car Manufacturers and EV Startups

Frequently Asked Questions

New car manufacturers have turned the auto industry into something much more dynamic, and, at times, more chaotic, than the slow, predictable world it used to be. For you as a driver, that can mean better technology, sharper design, and surprising value, but only if you go in with clear eyes about the risks. If you’re exploring a used EV from a newer brand, pairing your own research with independent tools like the Recharged Score Report is the smartest way to enjoy the benefits of these newcomers without becoming collateral damage in the next round of consolidation.