Searches for India electric cars have spiked over the last two years, and for good reason. India is one of the fastest‑growing EV markets in the world, with homegrown players like Tata and Mahindra pushing affordable electric SUVs and hatchbacks while global brands such as MG, Hyundai and Kia chase higher‑margin volume. If you follow EVs, invest in the auto sector, or shop used electric vehicles in markets like the U.S., the way India electrifies will increasingly matter to you.

Why India’s EV story is different

India electric car market snapshot in 2025

India’s EV momentum by the numbers

By late 2024 and early 2025, India had subsidised over 16 lakh (1.6 million) EVs under its flagship programmes, most of them scooters, motorcycles and three‑wheelers. Passenger cars account for a smaller share but are climbing from a low base, posting double‑digit year‑on‑year gains in fiscal 2025. Luxury brands are seeing traction too, BMW, for example, now reports that more than a fifth of its India volume is electric, signaling that upper‑income buyers are increasingly comfortable with battery power.

Think of India as a demand lab

Key policies shaping India’s electric cars push

Policy explains much of the acceleration in India electric cars. Since 2015, the central government has relied on a series of schemes to nudge both buyers and manufacturers away from internal‑combustion engines and toward electric drivetrains.

- FAME I and FAME II: The Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles schemes have provided purchase subsidies for EVs and capital support for charging infrastructure. Phase II, launched in 2019 with over ₹11,000 crore in budget, has backed more than 1.6 million vehicles and thousands of chargers.

- PM E‑DRIVE: Announced in late 2024 as FAME winds down, PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E‑DRIVE) earmarks roughly ₹10,900 crore over two years, including a sizable allocation for new public charging stations and domestic manufacturing support.

- State‑level policies: States like Delhi, Maharashtra, Tamil Nadu and Gujarat layer on their own perks, road‑tax waivers, registration discounts, scrappage incentives and local manufacturing subsidies, creating pockets of especially strong EV economics.

- Fuel‑efficiency and emissions rules: India’s CAFE and emissions standards are tightening over time, even as regulators weigh easing future norms for small petrol cars. That tension will shape how aggressively OEMs push low‑cost EVs versus stretching the life of efficient ICE models.

Subsidy volatility is real

Top electric cars in India in 2025

On the ground, India’s EV story is no longer just about pilot projects. Fiscal 2025 sales league tables show mainstream and premium brands rubbing shoulders, with price points spanning from compact city runabouts to full‑size luxury SUVs.

Who’s selling India’s electric cars today?

A quick look at leading players and what they offer

Tata Motors

Tata is the volume leader in India’s electric passenger car segment, with models such as the Punch EV, Nexon EV, Tiago EV and Tigor EV.

- Focus on sub‑₹20 lakh pricing.

- Shared platforms with ICE models to keep costs in check.

- Strong presence in smaller cities, not just metros.

MG Motor India

MG’s portfolio includes the compact Comet EV, the popular Windsor EV crossover and the larger ZS EV.

- Targets tech‑savvy buyers with connected‑car features.

- MG Windsor EV has emerged as a bestseller since its late‑2024 launch.

- Higher average transaction prices than most Tata models.

Mahindra, Hyundai, Kia & others

Mahindra’s XEV 9e and BE 6 ride on a dedicated EV platform, while Hyundai Creta Electric, Ioniq 5, Kia EV6 and EV9 plug into the premium and performance segments.

- Blend of mass‑market crossovers and halo imports.

- Important for brand image and technology transfer.

- Lower volume than Tata and MG today, but growing.

Representative electric cars in India (2025)

Illustrative models showing how segments and price bands stack up. Prices are approximate ex‑showroom ranges and can vary by state incentives and trim.

| Model | Segment | Approx. price band (₹ lakh) | Key talking point |

|---|---|---|---|

| Tata Tiago EV | Entry hatchback | 8–11 | One of India’s most affordable electric cars; suitable for city duty. |

| Tata Punch EV | Compact SUV | 11–15 | Taps into India’s love for SUVs with upright stance and practical range. |

| Tata Nexon EV | Subcompact SUV | 14–20 | Among the earliest mainstream EVs; strong recognition and wide charging support. |

| MG Comet EV | City car | 7–10 | Ultra‑compact size aimed at congested urban cores, with smartphone‑style interior. |

| MG Windsor EV | Compact crossover | 15–20 | A top seller since late 2024 launch, blending range, features and price. |

| Mahindra BE 6 | Mid‑size SUV | 30–40 | Dedicated EV platform with long claimed range and fast‑charge capability. |

| Hyundai Creta Electric | Compact SUV | 20–25 | Electrifies one of India’s best‑known ICE nameplates. |

| Kia EV6 / Hyundai Ioniq 5 | Premium crossover | 45–65 | Tech‑heavy halo cars showcasing 800‑volt fast charging and long‑range road‑trip ability. |

Compact hatchbacks and crossovers dominate India’s electric car landscape, with premium imports playing a branding role.

Pricing, running costs and total cost of ownership

Sticker prices for India electric cars still sit above comparable petrol or diesel models in most segments, but the gap has narrowed. In the sub‑₹20 lakh band, buyers can now pick from multiple EVs with real‑world city range in the 200–350 km bracket, enough for daily commuting and short highway hops.

Upfront price

- Entry EVs like the Tiago EV and MG Comet EV start under ₹10 lakh in some states after subsidies.

- Volume crossovers such as the Punch EV, Nexon EV, Windsor EV and Creta Electric typically land between ₹12–25 lakh.

- Dedicated‑platform SUVs and imports push well past ₹30 lakh, often into luxury‑car territory.

Running costs

- Per‑km energy cost is usually far lower than petrol or diesel if you charge at home or workplace tariffs.

- Fewer moving parts cut routine maintenance, no oil changes, fewer filters and reduced brake wear from regen.

- Commercial users (taxis, fleets, delivery) see payback fastest because they rack up daily kilometres.

Where EVs already win on cost

Charging infrastructure: where you can plug in

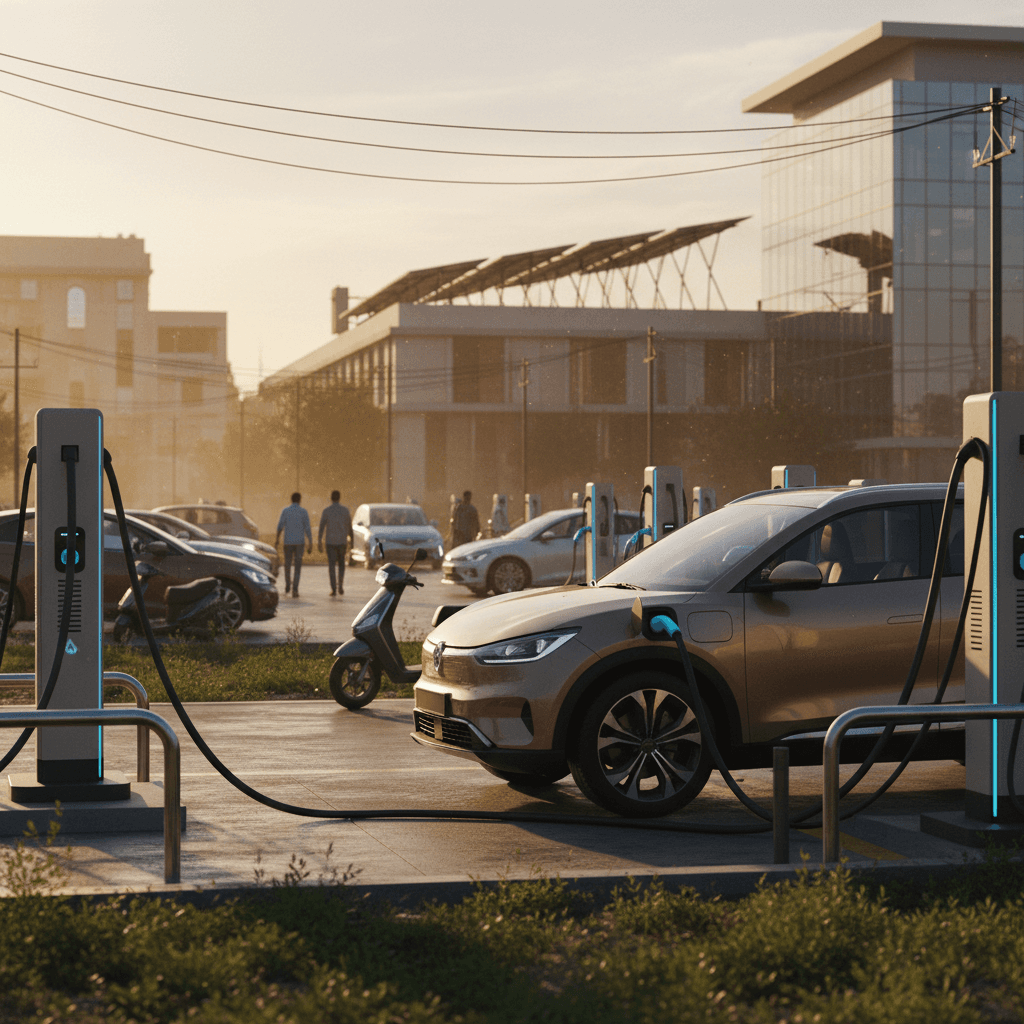

Charging remains one of the biggest swing factors for EV buyers in India. The country has moved quickly from pilot projects to a network of tens of thousands of charge points, but coverage is uneven and heavily concentrated in certain corridors and states.

India’s public charging build‑out

- Home charging: For many early adopters, a 7 kW AC wallbox at home is the primary energy source. Apartment dwellers still face hurdles getting societies and utilities on board, though rules are slowly evolving.

- Public DC fast charging: Oil marketing companies and private networks are installing 30–150 kW stations along highways and in city centres. For now, queues can form during holiday peaks, but utilisation varies widely by region.

- Destination and workplace charging: Malls, office parks, hotels and gated communities are adding slower AC chargers as amenities, helpful for top‑ups, less so for road‑trip planning.

How owners manage range today

What’s driving (and slowing) consumer adoption

Despite rapid growth, EV penetration in India’s car parc is still small. The same push‑and‑pull forces visible in other markets show up here, just with a sharper focus on cost, infrastructure, and resilience of the supply chain.

Why Indian consumers say yes, or not yet, to EVs

Four themes show up repeatedly in surveys and dealer interviews

Drivers of adoption

- Operating cost savings are the top motivator, especially for high‑mileage commuters and commercial operators.

- Urban air quality concerns push cities and fleets toward quieter, zero‑tailpipe‑emission vehicles.

- Feature‑rich cabins (large touchscreens, connected apps) help EVs feel more modern than similarly priced ICE rivals.

Barriers to adoption

- Upfront price premiums still squeeze first‑time buyers in price‑sensitive segments.

- Charging access is patchy, especially for apartment residents and small towns.

- Subsidy uncertainty and concerns about battery life make some households wait for clearer resale‑value data.

“We’re seeing first‑time luxury buyers in India jump straight to electric. That’s a structural shift, not just a fad.”

India’s used electric car market: early but important

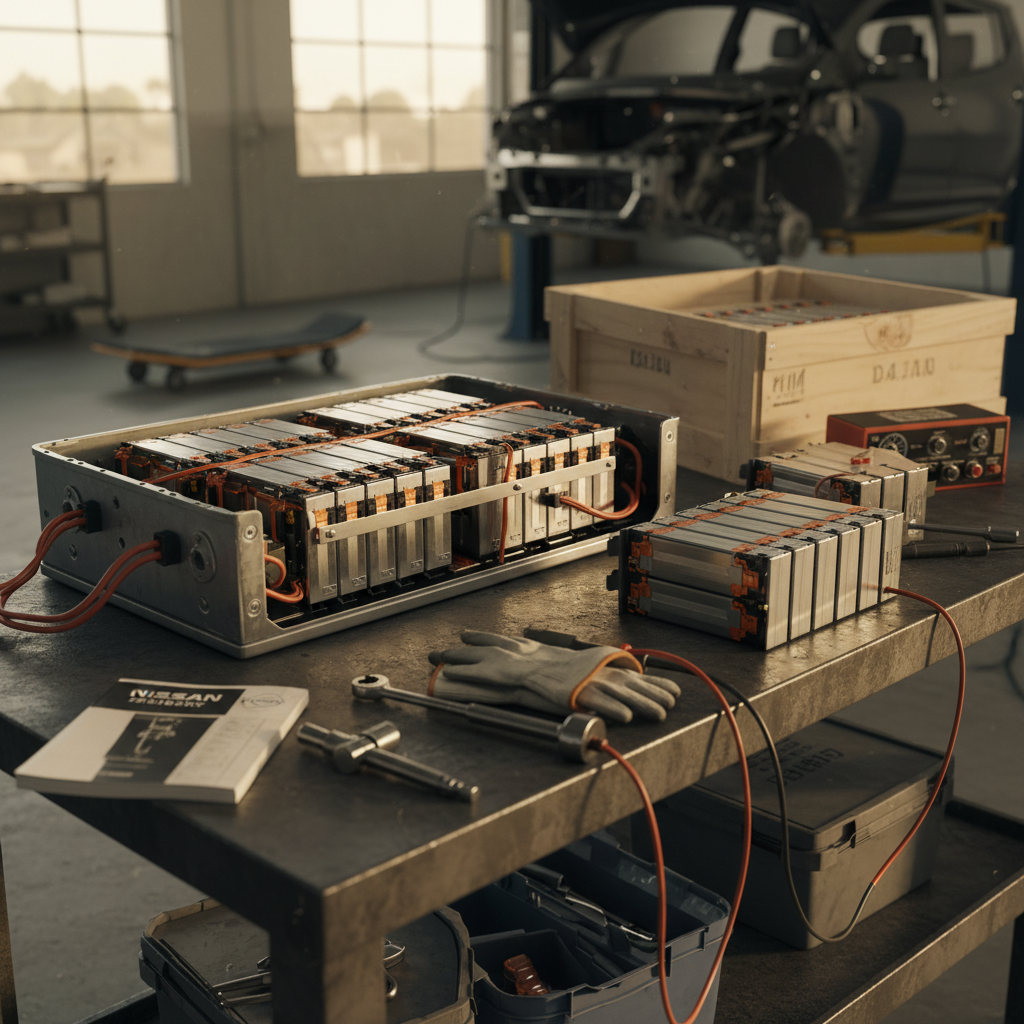

A mature EV ecosystem needs a healthy second‑hand market. India is just starting that journey for electric cars. Early Nexon EVs and other first‑generation models are now filtering into used‑vehicle channels, giving dealers and online marketplaces a chance to test residual values and warranty expectations.

What’s shaping used EV values in India

1. Battery health transparency

Buyers increasingly ask for state‑of‑health data and remaining warranty coverage before committing. Without it, discounts widen quickly.

2. Brand and service reach

Mainstream brands with dense dealer and service networks (Tata, Mahindra, Hyundai) command more trust than niche or exiting players.

3. Software and feature longevity

Connected features, app support and over‑the‑air updates matter for perceived shelf life, especially among younger city buyers.

4. Charging access by city

Used EVs in major metros with good public and destination charging tend to hold value better than those in charging “deserts.”

The risk of orphaned products

Why India’s EV shift matters even if you buy in the U.S.

If you’re shopping for a used EV through a retailer like Recharged in the United States, India’s vehicle mix might feel far away. But India’s push into affordable EVs has a few concrete implications for shoppers thousands of miles away.

- Platform sharing: Global automakers often develop low‑cost EV platforms in India and other emerging markets, then adapt them for North America and Europe. Lessons learned on durability, software and charging behaviour tend to travel quickly.

- Battery supply and chemistry: India’s scale in two‑wheelers and compact cars gives cell suppliers another massive outlet, influencing which chemistries (like LFP) become cheaper and more widely available worldwide.

- Residual‑value data: Track how first‑wave Indian EVs age. Their battery‑health and resale patterns will inform global thinking about warranties, pricing and remarketing strategies for budget EVs. That’s precisely the kind of data Recharged looks at when assessing battery health and fair market pricing on used EVs.

- Policy experiments: India’s mix of central schemes and state‑specific incentives offers a policy laboratory. Expect elements of those programmes to inspire municipal and state‑level pilots elsewhere.

How to evaluate Indian‑built EVs in the used market

Over time, more India‑engineered components and platforms will show up indirectly in vehicles sold in North America and Europe, even if the nameplates differ. When you’re considering any value‑oriented EV, whether or not it was built in India, you’ll want to lean on a structured evaluation rather than gut feel.

Technical checklist

- Battery state of health: Look for verified diagnostics rather than relying on dashboard range estimates alone.

- Fast‑charging performance: Ask how the car behaves on DC fast chargers after several years of use, does it throttle early or maintain rated power?

- Software support: Confirm whether the OEM is still pushing updates and security patches.

Ownership and support

- Warranty coverage: Check remaining battery and drivetrain warranty and any transfer conditions.

- Service footprint: Make sure there’s a practical service network where you live.

- Independent testing: Whenever possible, rely on third‑party battery health reports and fair‑market‑value tools rather than seller claims.

How Recharged approaches this

FAQ: India electric cars in 2025

Frequently asked questions about India electric cars

Bottom line: India’s electric cars are entering the mainstream

India’s EV transition doesn’t look exactly like the U.S. or Europe, two‑wheelers lead the charge, subsidies are finely targeted, and affordability is non‑negotiable. But electric cars are no longer a novelty. From sub‑₹10 lakh city cars to premium crossovers, the market now offers genuine choice, backed by a charging network that, while uneven, is expanding rapidly.

For global automakers, India is a proving ground for frugal yet feature‑rich EVs. For shoppers in markets like the United States, it’s an early glimpse of where value‑oriented electric platforms and battery chemistries are headed. And for used‑EV buyers specifically, the key takeaway is simple: wherever an EV was first designed or built, demand for transparent battery health, fair market pricing and expert guidance is only going to grow. That’s where services like Recharged, with its battery‑focused Recharged Score and specialist support, aim to turn a fast‑moving, global EV market into a simpler, more confident ownership experience.